Building Wealth: 5 Hard Truths

How to Escape the Matrix

The storm is not coming. The storm has arrived.

We are living through the greatest capital reallocation in human history. The old world is forgotten. The world of steady pensions, company loyalty, and linear progression is dead.

It didn’t just die. It was murdered by the algorithm. It was dismantled by automation. It was eroded by inflation.

The politicians and central bankers are going to blame AI but the “bad guys” in this are the Elites and their Technocratic Control Class.

And yet, you are still operating with a map from 1990.

You are walking through a minefield blindfolded.

You believe that if you work hard, save 10%, and buy a diversified portfolio of ETFs, you will be safe. You believe that if you keep your head down, the system will protect you. You believe inflation is a normal affair in a healthy economy.

This is a lie.

The system is not designed to protect you. The system is designed to extract energy from you.

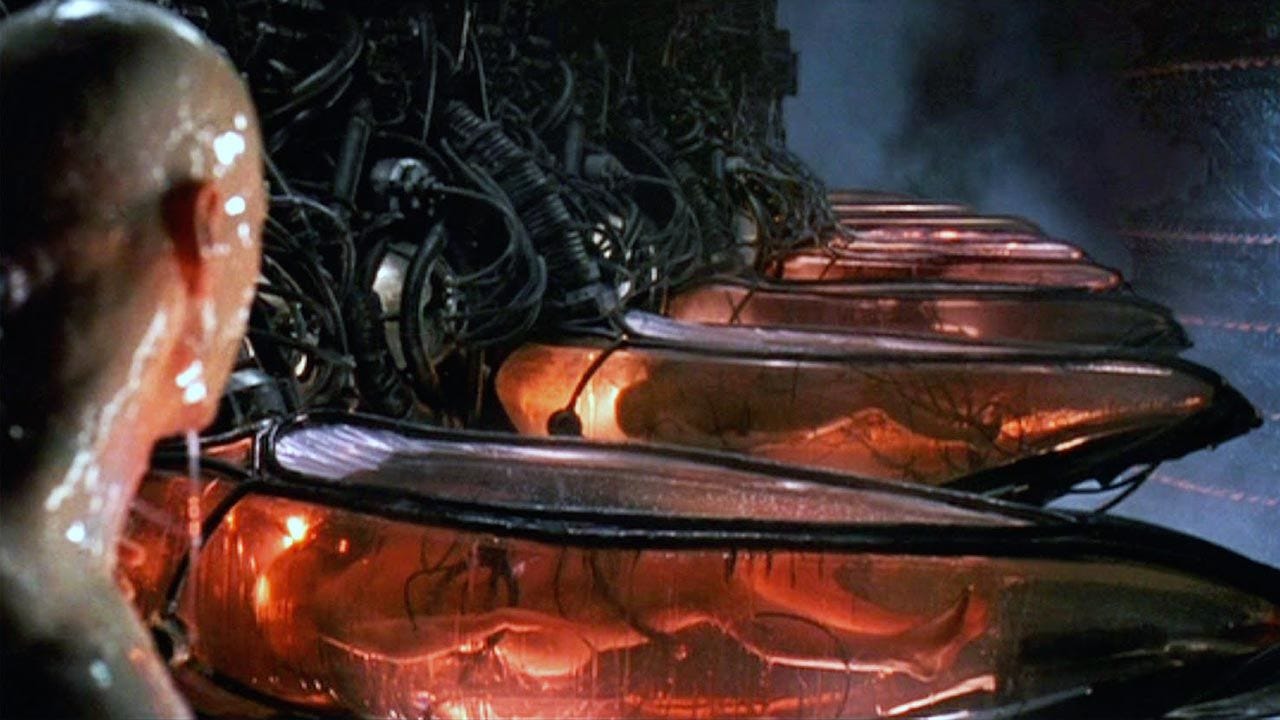

You are not a citizen of this economy. You are fuel being digested by the system.

To survive this, you do not need a “financial plan” or a budget app.

You need to get out of the Pod and build a defensive position.

You need a Citadel.

You need to view Wealth Building not as a game of accumulation, but as a project of architectural survival. You are the Architect. You are the Engineer. And right now, your fortress is made of straw.

We are going to burn that straw down.

We are going to pour concrete.

Here are the 5 Hard Truths to Building Wealth in the Age of Chaos. You need to understand these to escape the Matrix.

Truth 1: The Salary is Sedation

Most of you are addicts.

You are not addicted to drugs. You are not addicted to alcohol. You are addicted to the deposit.

The bi-weekly paycheck is the most dangerous narcotic in the modern economy.

It is designed to be exactly enough to keep you alive, and exactly small enough to keep you coming back. It dulls your senses. It blinds you to risk. It makes you docile.

When you trade your time for money, you are making a fatal engineering error.

You are selling the only finite resource you possess (time) for a resource that can be printed to infinity: currency.

This is bad math. This is a structural failure.

As long as your income is tied linearly to your presence, you are not building a fortress. You are renting a room in someone else’s prison.

If you stop working, the money stops flowing. The walls crumble. The roof collapses.

You have zero structural integrity.

The Hard Truth is this: You must disconnect your input from your output.

You must transition from a Laborer to an Owner. You can do this by building, or investing.

This does not mean you quit your job tomorrow. That is suicide.

It means you view your job differently. Your job is not your life. Your job is your venture capital backer.

You take the capital from the job, and you pour it into the construction of assets that breathe on their own.

You build a product. You write code. You create media. You acquire equity.

You build systems that work while you sleep.

If you are not building equity, you are digging a hole. And eventually, you will be too old to climb out.

Stop renting your existence. Build the deed.

Truth 2: Comfort is Corrosion

Look at the modern male. Look at the modern worker.

Soft.

We are obsessed with “work-life balance.” We are obsessed with “self-care.” We are obsessed with comfort.

In the world of physics, entropy is the rule. Disorder increases over time. Things fall apart.

A building left alone does not get stronger. It rots. Rust sets in. Vines crack the stone.

Your life is no different.

If you are comfortable, you are decaying.

Comfort is not a reward. Comfort is corrosion.

When you seek the path of least resistance, you are signaling to your biology and your psychology that the war is over. You shut down the engines. You let the gears seize up.

Wealth is not built in the safety zone. The Citadel is not built on a sunny day.

The Citadel is built in the rain. It is built in the mud. It is built when you are tired.

You want to be rich? You must learn to metabolize pain.

You must view stress not as a threat, but as a load-bearing test.

When a beam is put under pressure, it holds up the roof. When a muscle is put under tension, it grows.

You must seek out High-Friction environments.

Take the difficult project. Start the business that scares you. Have the uncomfortable negotiation.

Most people run from friction. They seek the smooth path.

This is your advantage.

If you can endure the friction that destroys others, you inhabit a marketplace with zero competition.

The crowd is at the bottom of the mountain, fighting over scraps in the comfort zone.

The air is thin at the top. It is cold. It is hard to breathe.

That is why there is so much room up there.

Stop trying to make your life easier. Try to make your structure stronger.

Truth 3: You Are Not an Investor (Yet)

Stop looking at the stock market.

Stop looking at crypto.

Stop looking at real estate yields.

You have $10,000 in the bank. You have $50,000 in the bank. Even if you have $100,000.

A 7% return on $10,000 is $700.

$700 does not change your life. $700 does not buy you freedom. $700 buys you a new phone.

You are obsessing over the wrong variable.

You are trying to optimize the “Return on Capital” (ROC) when you have no capital.

That’s the wrong ROC.

You need to optimize the “Return on Character.”

You are the Asset.

In the early stages of Citadel construction, you do not buy external fortifications. You reinforce the Keep.

You are the machine that generates the cash flow. If the machine is broken, the investment portfolio is irrelevant.

Every dollar you have should be poured back into the engine.

Upgrade your wetware.

Upgrade your skills.

Upgrade your network.

Upgrade your physical chassis.

If you spend $2,000 on a course that teaches you how to sell, and that skill adds $50,000 to your income every year for the next ten years offering the foundation for passive wealth, that is not a 7% return.

That is an infinite return.

People are terrified of spending money on themselves. They clutch their pennies. They put them in a savings account that yields negative real value after inflation.

They are protecting a melting ice cube.

Meanwhile, the machine that matters most, the brain, is rusting.

You must become aggressive with your self-development.

You must become a ferocious learner.

Read the books others won’t read. Learn the technical skills others are too lazy to learn. Master the psychology others ignore.

A Life Plan for People Who Want to Win

The first time I saw a billion-dollar balance sheet up close, it wasn’t the number that struck me.

Until you have a surplus of cash flow that you literally cannot spend on self-improvement, you are not an investor.

You are a builder. And the project is You.

Truth 4: Leverage is the Only Force Multiplier

Archimedes said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

He was not talking about physics. He was talking about life. He was talking about wealth.

Linear effort yields linear results.

If you carry stones one by one, you will build a hut. It will take you fifty years. And the first wolf that comes along will blow it down.

If you build a crane, you can move ten thousand stones in a week.

Wealth is not a function of effort. Wealth is a function of Leverage.

There are four forms of Leverage. You need to master them.

1. Labor Leverage. This is people working for you. It is the oldest form. It is messy. It requires management. But it is necessary. You cannot lay every brick yourself.

2. Capital Leverage. This is money working for you. It is scalable. But you need money to get it. (See Truth 1).

3. Code Leverage. This is the new economic god. You write the software once. It runs a million times. It never sleeps. It never asks for a raise. It never complains. It is the perfect soldier.

4. Media Leverage. This is the content you create. This article is leverage. I write it once. Thousands of you read it. My thoughts are cloned. My influence is multiplied.

Look at your current workflow.

Where is the leverage?

If you stop, does the value stop?

If the answer is yes, you have zero leverage. You are operating at 1:1.

You need to operate at 1:1000.

You need to decouple your effort from your reward.

Build tools. Record content. Write code. Hire teams.

Do not be the mule carrying the load. Be the engineer designing the pulley system.

The mule works harder than the engineer. The mule dies tired and poor. The engineer owns the farm.

Is it all free money in the digital world?

No, there is real work to be done to succeed and costs to be paid. Software rots. APIs change. Servers crash. Code leverage requires a constant stream of maintenance to prevent collapse. The "marginal cost of replication" is zero, but the "marginal cost of complexity" is high.

AI helps with making code, debugging it, maintaining it… but there are still hours that have to be invested to support any development. Physical or digital.

Truth 5: Sovereignty is the Goal (Not Money)

Why are we doing this?

Why build the Citadel? Why suffer the friction? Why maximize the leverage?

Is it for a Lamborghini? Is it for a Rolex? Is it for status?

If that is your motivation, you will fail.

Status is a trap. Status is just another form of slavery. You are performing for an audience that does not care about you.

You are buying things you don’t need, with money you don’t have, to impress people you don’t like.

That is not wealth. That is a high-functioning poverty.

The goal is not “Rich.”

The goal is Sovereign.

Sovereignty is the ability to say “No.”

“No” to the boss who disrespects you. “No” to the client who drains you. “No” to the obligation that wastes your time. “No” to the location you hate living in.

Sovereignty is the state of total independence. It is the ability to stand inside your Citadel, pull up the drawbridge, and exist on your own terms.

It is having your own power supply. Your own water source. Your own defense systems.

When you are Sovereign, you cannot be coerced. You cannot be cancelled. You cannot be starved out.

This is the only definition of success that matters.

Everything else is decoration.

Money is just the ammunition. Sovereignty is the victory condition.

Do not confuse the tool with the objective.

You are not stacking cash to buy toys. You are stacking cash to buy your freedom.

The Final Assessment

Look at your life again.

Look at your bank account. Look at your skills. Look at your daily habits.

Is this the behavior of a Commander building a Fortress? Or is this the behavior of a refugee hoping for a handout?

The gap between where you are and where you need to be is massive and can only get smaller if you build systems and gain leverage daily.

You can close this page. You can go back to scrolling. You can go back to the sedation of the paycheck and the comfort of the couch. You can hope the storm passes.

…it won’t.

Or… You can pick up a brick.

You can accept that no one is coming to save you. You can accept that the world owes you nothing. You can accept that you are the architect of your own rescue.

The ground is hard. The work is heavy. The hours are long.

But the view from the top? The ability to protect and provide for your family? The ability to be able to even afford a family.

It is worth it. Start building.

True wealth is not just the ability to say “No” to the world; it is the capacity to say “Yes” to the parts of it you love, without fear of ruin. The Citadel is a good place to retreat to during a storm, but it is a terrible place to live.

We build the Citadel first to establish a defensive base and ensure our survival.

Next we build our armies and go take new lands.

Friends: in addition to the 17% discount for becoming annual paid members, we are excited to announce an additional 10% discount when paying with Bitcoin. Reach out to me, these discounts stack on top of each other!

👋 Thank you for reading Wealth Systems.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.

Strong framing on how leverage decouples effort from reward. The Citadel metaphor works well because it shifts the mindset from accumulation to architectural resilience. I've seen people grind for years in high-friction enviroments without actualyl building leverage, just burning themselves out faster. The key distinction is that stress only builds the structure if its load-bearing and intentional, not just noise masking as progress.