Dividends, Dividends, Dividends

You Won't Make It By Working For Someone Else

Quick sanity check: I’ve been writing about wealth systems, AI, dividends, options, bitcoin, e-commerce, wealth engines, and dozens of other wealth-related topics since 2023….

Are you learning anything or gaining anything from this?

Over 215 pieces published and less than 20 replies.

Total.. in almost 3 years.

A rotating group of people who engage with occasional articles.. but near-zero comments. No questions. No feedback on what you are building. I did this to engage, share and learn. To offer what I see working on Wall St and across the business world.

Are you getting anything from this? Are you becoming more sovereign?

I hope so!

The standard model of “career” is collapsing.

The salary is a bribe. It is a monthly subscription fee paid to you for the leasing of your time.

But inflation is the silent artillery constantly shelling that position.

Every year, your labor buys less. The cost of sovereignty (housing, energy, quality food) is skyrocketing. The cost of cheap distractions is dropping.

Netflix, sugar and plastic for all!

This is not an accident. It is an algorithm.

And you are on the wrong side of the equation.

Most men react to this with panic. They work harder. They hustle. They trade more time for diminishing returns.

They are running on a treadmill that is accelerating.

Eventually, the machine wins. The biology fails. You burn out.

There is only one exit Strategy.

You must stop being a laborer.

You must stop being a laborer.

You must stop being a laborer!

I keep saying it. Not getting a ton of replies saying what you are building toward. Have no idea if any of you are actually building the wealth engines I advocate for (Options, Dividends, E-Commerce, Lending, etc…).

Get a small engine spitting off capital. Use that excess capital to fuel the expansion of that engine until you are ready to activate wealth engine #2. Suddenly you have a multi-engine wealth system.

It can be a $500 dividend portfolio and a small e-commerce business where you share your research and analytic products, it can be anything.. but you must start building.

You need money to make money (it’s true) so start deploying your capital to create income streams. Even if they are small, they will grow due to compounding.

You must become a Capital Allocator.

You need to build a structure that exists outside of your own physical exertion.

You need a Dividend Holding Company.

This is not about “extra cash.”

This is not about “pizza money.”

This is about constructing a mechanical lung that breathes for you when you cannot.

It is about building a fortress where the bricks are made of equity and the mortar is made of cash flow.

But to build this, you must unlearn everything the financial media has taught you.

They want you to be a “consumer” of stocks.

They want you to chase the shiny object. They want you to look at the Yield and ignore the Engine.

We are going to dismantle the machine. We are going to look at the wiring.

We are going to turn you into an Wealth System Architect.

The Biological Diagnostics

A stock is not a lottery ticket. It is not a wiggle on a chart.

A stock is a legal claim on a living organism.

Companies are biological systems. They consume resources. They expend energy. They fight for territory. They reproduce capital.

When you buy a share, you are introducing a new organ into your financial body.

If you graft a necrotic organ onto a healthy body, you get sepsis.

If you buy a high-yield stock with a rotting core, you destroy your capital.

You must learn to read the Financial DNA.

Forget “Price.” Price is what you pay. Value is what you get.

Focus on the three vital signs.

Blood: Free Cash Flow

“Net Income” is the greatest lie in finance.

It is an accounting hallucination designed to smooth out reality for the tax man.

It includes things that do not exist in the real world, like Depreciation and Amortization.

You cannot pay your mortgage with Depreciation.

You cannot buy groceries with Amortization.

You can only pay dividends with Cash.

Many companies report massive “Profits” while they are bleeding to death.

They are borrowing money to pay the dividend.

This is a Ponzi scheme wrapped in a corporate logo.

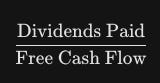

The Metric: Free Cash Flow

It is calculated:

This is the oxygen.

This is the cash left over after the company has paid its bills and fixed its factories.

If this number is negative, the dividend is a loan.

If this number is declining, the dividend is on death row.

The Test: The Cash Payout Ratio.

Do not use the standard Payout Ratio (based on Earnings). It is noise.

Use the FCF Payout Ratio:

The Safe Zone (< 60%): The organism is healthy. It has a 40% buffer. If a recession hits, if a factory burns down, the dividend survives. They have the capital to reinvest.

The Danger Zone (> 90%): The organism is gasping for air. Every penny that comes in immediately goes out. There is no margin for error. One bad quarter, and the cut happens.

Blood is vital for survival. But so is the ability to do stuff.

Muscle: Return on Invested Capital (ROIC)

FCF tells you if the company can survive today.

ROIC tells you if the company can dominate tomorrow.

This is the physics of the business. It measures torque.

It answers a simple question: How efficient is the machine?

If a company takes $1.00 of capital (from debt or shareholders) and invests it into the business:

A bad company generates $0.05 of return (5% ROIC).

A mediocre company generates $0.10 of return (10% ROIC).

A Compounder generates $0.20 of return (20% ROIC).

Why does this matter?

Because of the Reinvestment Loop.

The company with 5% ROIC cannot grow without begging for money. To open a new factory, they must borrow debt. Debt adds risk. Risk kills dividends.

The company with 20% ROIC is a perpetual motion machine.

They generate so much cash from their internal operations that they can fund their own growth and pay you a rising dividend.

They do not need the bank. They do not need the Fed.

They are Sovereign.

The Command:

Filter your list.

If ROIC is below 10%, delete the ticker.

You are looking for Efficiency Monsters.

3. The Brain: Economic Value Added (EVA)

Most investors are mathematically illiterate.

They see “Profit” and think “Good.”

They forget the Cost of Capital.

Capital is not free.

Equity has a cost (risk). Debt has a cost (interest).

This combined cost is the WACC (Weighted Average Cost of Capital).

If a company makes a 6% profit, but it costs them 8% to rent the capital...

They are not making money.

They are destroying value.

They are burning the furniture to heat the house.

Eventually, they run out of furniture.

Then the dividend gets cut. Then the stock goes to zero.

The Metric - EVA:

You want Positive EVA.

You want a management team that understands that size is vanity, but profit is sanity.

A smaller company with high EVA is infinitely superior to a massive conglomerate with negative EVA.

The Three Archetypes

Once you have filtered for DNA, you must structure the portfolio.

Do not just buy a random grab bag of tickers.

You are building an Army.

An army needs Tanks. It needs Snipers. It needs Supply Lines.

You need to deploy your capital into specific strategic roles.

There are three Archetypes of dividend stocks.

You need to understand the mission of each.

Archetype A: The Financial Fortress

Think of this as your compounding force.

The Representative: Procter & Gamble (PG), Johnson & Johnson (JNJ).

The Mission: Wealth Preservation and Multi-Generational Growth.

These are the boring companies. The media ignores them.

They are not AI. They are not crypto.

They simply own the world.

Think about Procter & Gamble.

Tide. Pampers. Gillette. Crest.

When the economy collapses, people stop buying Teslas.

They do not stop washing their clothes. They do not stop brushing their teeth.

The Mechanics:

Low Yield (2.0% - 2.5%): You will look at this and say, “That is too low.” You are wrong.

High Growth (6% - 8%): They raise the dividend every single year.

The Moat: Their brand power allows them to raise prices to match inflation.

The Math of the Fortress:

If you buy a 2.5% yield that grows at 8% per year...

In 10 years, your “Yield on Cost” is over 5%.

In 20 years, your Yield on Cost is over 11%.

And the stock price has likely tripled.

This is how you build a dynasty. You do not buy this for rent money next month.

You buy this so your grandchildren never have to submit a resume.

Archetype B: The Monetary Mercenary

This is your high-yield extraction engine.

The Representative: Altria Group (MO), British American Tobacco (BTI).

The Mission: Immediate Income Injection.

Sometimes, you need cash now.

You need to pay bills. You need to fund new positions.

You call in the Mercenaries.

Altria is the perfect case study.

It sells cigarettes. The volume of smokers is declining by 8% a year. The business is technically shrinking.

But the addictiveness is the asset. Because the product is inelastic, Altria raises prices by 10% every year.

The price hike offsets the volume loss.

The Mechanics:

Massive Yield (8% - 9%): They pay out almost all their cash.

Low Growth (2% - 3%): They cannot grow fast. They are mature.

The Trap: This is a melting ice cube.

The Strategy:

You treat this like an oil well.

You buy it. You extract the heavy dividends.

You do not reinvest the dividends back into Altria.

You take that massive 9% cash flow and you use it to buy more shares of the Fortress (PG).

You use the dying business to fund the growing business.

Archetype C: The Income Infrastructure

Here we diversify, capture energy from another part of the economy.. and we start collecting monthly checks, too.

The Representative: Realty Income (O), VICI Properties (VICI).

The Mission: Consistent Monthly Cash Flow.

These are Real Estate Investment Trusts (REITs).

They are not “companies” in the traditional sense.

They are financing vehicles.

Realty Income owns 13,000 properties. 7-Eleven, FedEx, Dollar General.

They do not run the stores. They own the concrete box the store sits in.

They operate on Triple Net Leases.

N1: Tenant pays Property Taxes.

N2: Tenant pays Insurance.

N3: Tenant pays Maintenance.

If the roof leaks at the 7-Eleven, Realty Income does not care. That is 7-Eleven’s problem.

Realty Income just checks the mailbox.

The Mechanics:

The Spread: They borrow money at 5%. They buy buildings that yield 7%. They pocket the 2% difference.

The Risk: Interest Rates.

When the Fed raises rates, the cost of borrowing goes up. The spread shrinks.

When rates are high (like now), REITs get punished. Their stock prices fall.

This is the opportunity.

You buy the land when the cost of money is high, and you wait for the cycle to turn.

The Metric Shift:

Do not look at EPS (Earnings Per Share) for a REIT.

Real estate has “Depreciation.” This creates a massive tax deduction that lowers Net Income, but does not lower Cash.

Look at AFFO (Adjusted Funds From Operations).

If the dividend is covered by AFFO, the rent is safe.

But there is danger in dividend investing.