Exiting the Income Class, Part II

Writing Options

You read this and got excited.

You asked for the blueprint. You want to stop gambling and start being the House.

Good.

The Casino is the ultimate Capital Class business. It does not rely on luck. It relies on statistics. It relies on the Law of Large Numbers. When a player walks in, they are betting against math.

Math always wins.

Most people treat the stock market like a slot machine. They buy a stock. They pray. They buy a call option for even more leverage because they read a post on Reddit. They are hoping for a jackpot.

They are the Labor Class of the market. They are paying for the privilege of playing.

You are going to switch sides.

You are going to stop buying lottery tickets. You are going to start selling them.

This is the execution plan for Engine 3: The Yield Accelerator.

Specifically, we are going to master The Wheel Strategy.

And we are going to deploy it in the “Goldilocks Zone” of time decay: 30 to 45 Days to Expiration.

This is not about guessing where the stock goes. This is about exploiting the structural reality of how options are priced. This is about selling a wasting asset to people who think they can predict the future.

Let’s build the machine.

The Core Philosophy: Selling Time

Before we touch a button, you must understand what you are actually selling.

An option price is made of two things.

Intrinsic Value: The real value if the option was exercised today.

Extrinsic Value: The “Hope” value. The value of time. The value of implied volatility.

We are selling Extrinsic Value. We are selling time.

Time only moves in one direction. It disappears. As time passes, the “time value” of an option must go to zero. It is a melting ice cube.

Your goal is to sell the ice cube to someone else, hold the cash they paid you, and watch the cube melt into a puddle. When it is gone, you keep the cash.

This phenomenon is called Theta Decay.

Theta is the measurement of how much value an option loses every single day just because the sun came up and went down.

The Science of the 30-45 DTE Window

Why do we operate in the 30-45 day window? Why not sell weekly options? Why not sell yearly options?

This is not a random choice. It is based on the physics of the decay curve.

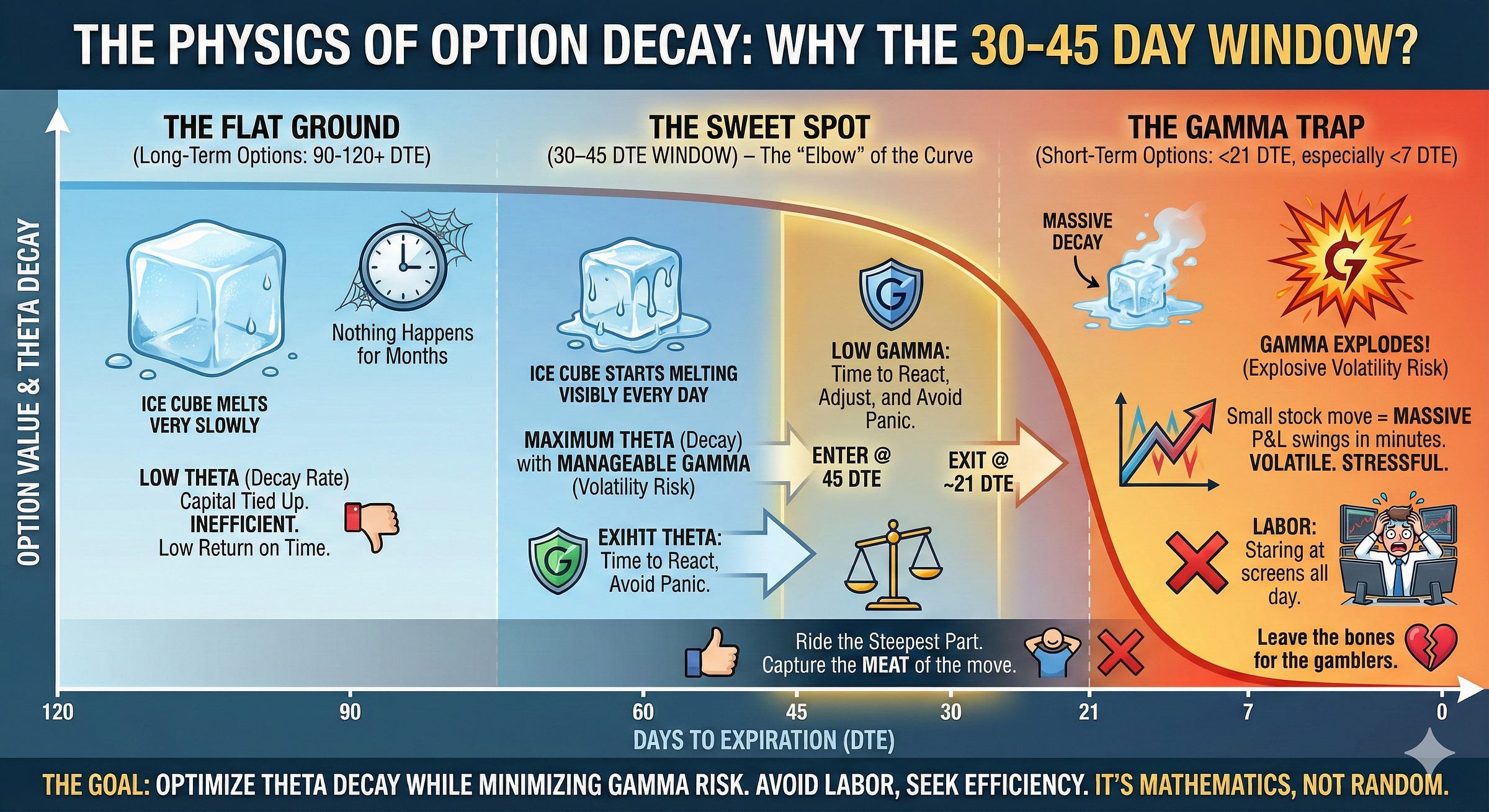

Imagine a cliff. Better yet, let’s look at one:

At 90 days or 120 days out (on the left of the chart), the ground is flat. The ice cube melts very slowly. If you sell an option 120 days out, nothing happens for months. Your capital is tied up. The return on time (Theta) is low. You are inefficient.

Now look at the last 7 days (on the right of the chart). The cliff is vertical. The decay is massive.

So why not sell 7-day options?

Gamma Risk.

This is the trap. Gamma measures how fast your position changes when the stock price moves. In the last week of an option’s life, Gamma explodes.

A small move in the stock price can turn a winning trade into a massive loser in minutes. It is volatile. It is stressful. It requires you to stare at the screen all day. That is Labor.

We don’t do Labor. We aren’t linear income constrained. We are elevating to the Capital Class.

We want the sweet spot.

The 30-45 DTE window is the “elbow” of the curve.

It is where the slope starts to steepen significantly. The ice cube starts melting visibly every day. But, you are still far enough away from expiration that Gamma is low.

If the stock moves against you in the 45-day window, you have time to react. You can adjust. You are not panicked.

This window offers the perfect mathematical balance: Maximum Theta (Decay) with Manageable Gamma (Volatility Risk).

You enter at 45 days. You ride the steepest part of the curve. You usually exit at 21 days, before the Gamma risk spikes. Sometimes I get closer to 14 days. I work hard to close out positions or roll them before then.

You capture the meat of the move and leave the bones for the gamblers.

The Strategy: The Wheel

The Wheel is a cyclical machine. It is designed to lower your cost basis on high-quality assets while generating cash flow.

It loops through two states:

The Cash Secured Put (The Acquisition Phase)

The Covered Call (The Income Phase)

You never leave the loop. You are always generating yield.

Let’s walk through a live simulation.

Phase 1: The Cash Secured Put

You have $15,000 in your brokerage account.

You identify a company you want to own. This is crucial. Rule #1 of the Wheel: Never wheel a stock you wouldn’t be happy holding for 2 years.

Let’s say you like “TechCorp.” It is trading at $150 a share.

You think $150 is a fair price, but you’d love to buy it for $140.

In the Labor Economy, you set a “Limit Order” at $140 and you wait. You sit there. Your cash sits there. It earns nothing. You are praying for a dip.

In the Capital Economy, we get paid to wait.

The Trade: You Sell (Write) a Put Option on TechCorp.

Strike Price: $140

Expiration: 45 Days from now.

Premium Received: $3.00 per share ($300 total contract value).

What just happened? You made a contract with the market. You said, “I promise to buy 100 shares of TechCorp at $140, any time in the next 45 days.”

To back up this promise, your broker locks $14,000 of your cash (100 shares x $140). This is why it is “Cash Secured.”

But you collect $300 immediately. That cash is yours. It hits your account instantly.

Now, we wait. Three things can happen.

Scenario A: The Stock Rips (Price goes up) TechCorp goes to $160. The person who bought your Put option is losing. They have the right to sell to you at $140, but the market price is $160. They would never do that. The option expires worthless. Result: You keep the $300. You keep your $14,000. You made a 2.1% return on your cash in 45 days (roughly 17% annualized). You repeat the process.

Scenario B: The Stock Stagnates (Price stays flat) TechCorp sits at $150. Same result. The option expires worthless. You keep the $300. You do it again.

Scenario C: The Stock Dips (Price goes down) TechCorp falls to $135. This is what we wanted. We wanted to own the stock. The option is “In The Money.” You are assigned. You must buy 100 shares at $140.

But look at the math. You paid $140 per share. But you received $3.00 per share in premium earlier. Your Net Cost Basis is actually $137.

You bought the stock at a discount, and you got paid to do it.

Now you own 100 shares of TechCorp. The Cash Secured Put phase is over.

You immediately switch the machine to Phase 2.

Phase 2: The Covered Call

You are now a shareholder. You are in the owner class.

Labor class investors just hold the stock and hope it goes up.

You are going to rent it out.

You Sell (Write) a Call Option on your TechCorp shares.

Current Stock Price: $135 (where it dropped to).

Strike Price: $145 (above your cost basis).

Expiration: 45 Days.

Premium Received: $4.00 per share ($400 total).

The Trade: You promise to sell your shares at $145 if it hits that price.

You collect $400 instantly. This reduces your cost basis again.

Previous Basis: $137. New Basis: $133 ($137 - $4 premium).

Do you see what is happening? Every time you spin the wheel, your breakeven price gets lower. You are engineering a margin of safety that passive investors do not have.

Now, we wait again.

Scenario A: The Stock Tanks TechCorp falls to $125. It hurts to see the asset value drop. But you sold the Call. You keep the $400. The Call expires worthless. You still own the shares. Next Move: You sell another Covered Call. You bring in another $300. Your basis drops to $130. You keep lowering your basis until the stock recovers.

Scenario B: The Stock Recovers (The Exit) TechCorp rallies to $150. Your Strike Price is $145. Your shares are “Called Away.” You must sell them at $145.

Let’s tally the score.

You bought at $140 (via the Put).

You sold at $145 (via the Call).

Capital Gain: $500.

Put Premium Received: $300.

Call Premium Received: $400.

Total Profit: $1,200.

Initial Capital: $14,000.

Return: 8.5% in roughly 90 days.

That is a 34% annualized return.

And what do you have now? You have $15,200 in cash. You have no stock.

You are back at the beginning. You circle back to Phase 1. You sell a Cash Secured Put.

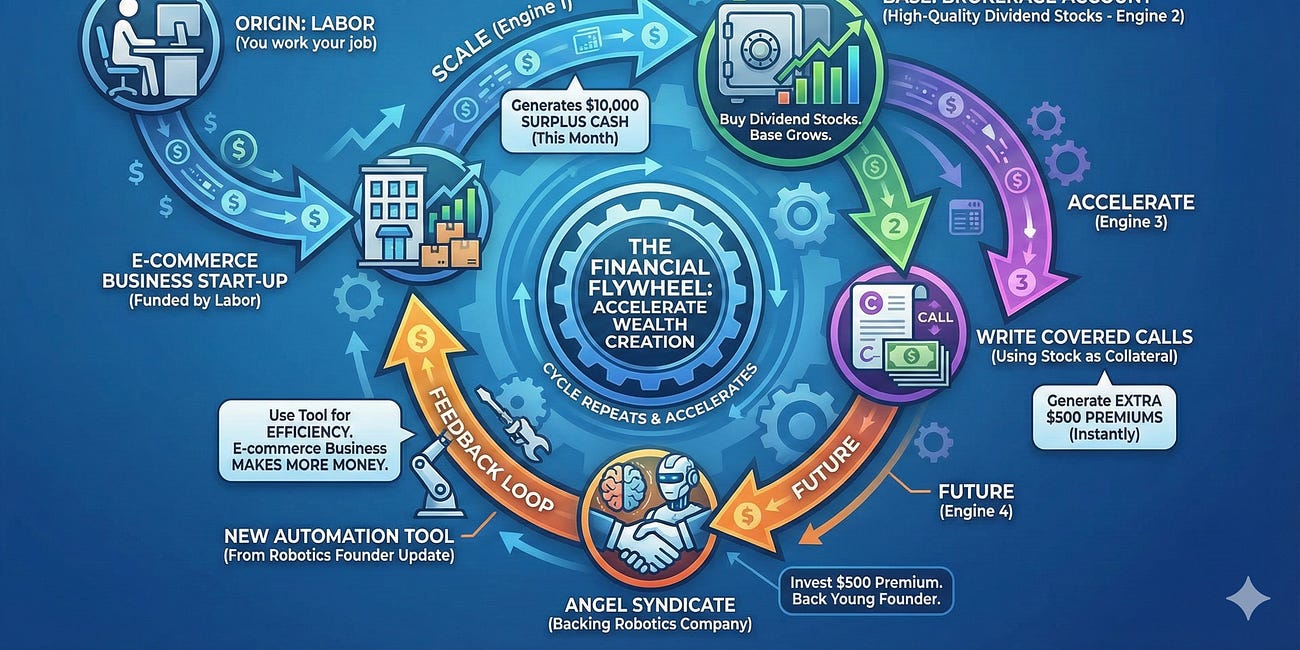

You spin the Wheel again. Pair this with a few other wealth engines, and you can see the power of the integrated wealth system approach.