How To: Building Interconnected Wealth Engines

Building wealth is becoming more difficult thanks to foolish monetary policy and shortsighted fiscal discipline. Some think these decisions are too consistently wealth destructive to be anything other than intentional — the ‘Elite’ attempting to burn the bridges to self-reliance so a permanent underclass of workers is stranded from reaching Wealth.

Prior posts have covered the difference between being rich vs wealthy, which ultimately depends on your definition of wealth.

Wealth is beyond the accumulation of money.

Wealth is freedom to navigate a wide range of options and the resources to do so successfully.

Can you still reach wealth even with the economic, demographic and ideologic headwinds?

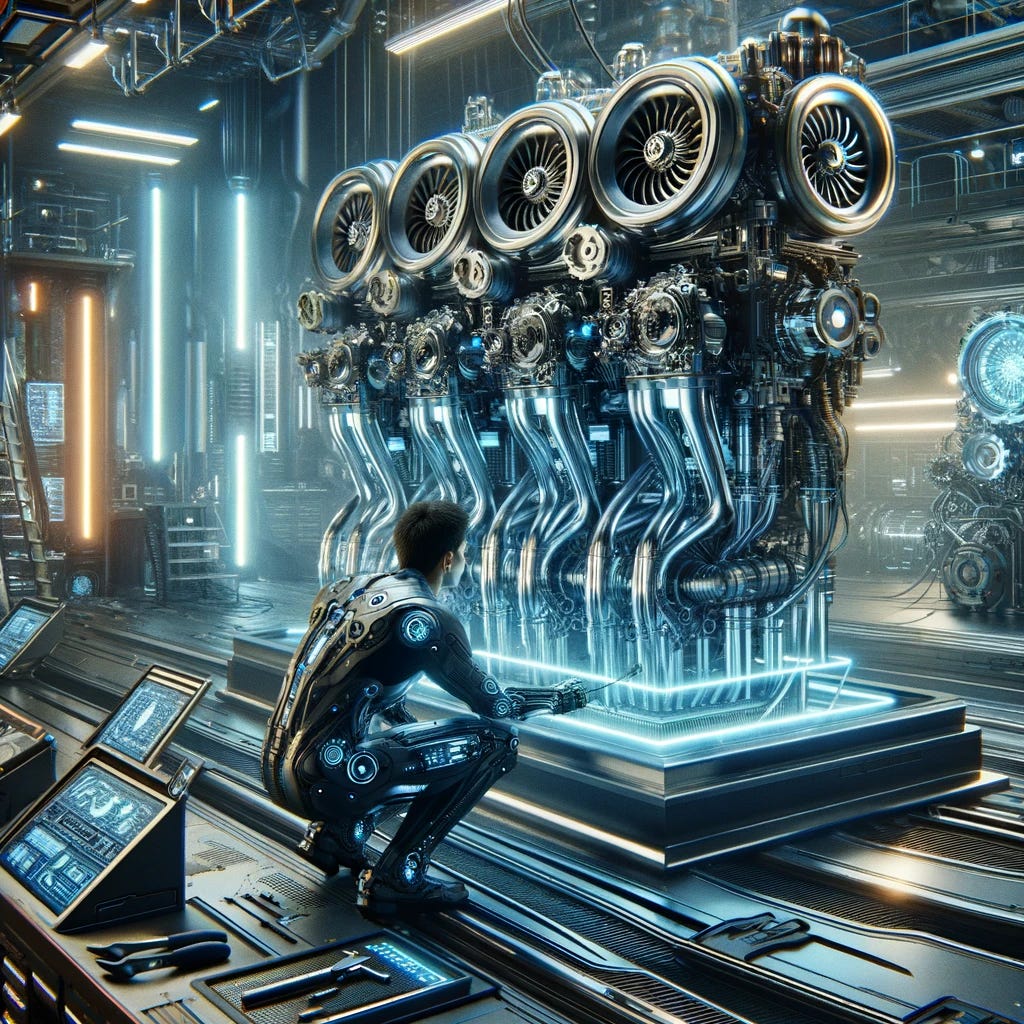

…with systems, anything becomes possible.

Why Multiple Wealth Engines?

The old adage "don't put all your eggs in one basket" has never been more relevant to building wealth than in today's rapidly evolving economic landscape. The traditional path of relying on a single job for income feels increasing…