Things are changing at

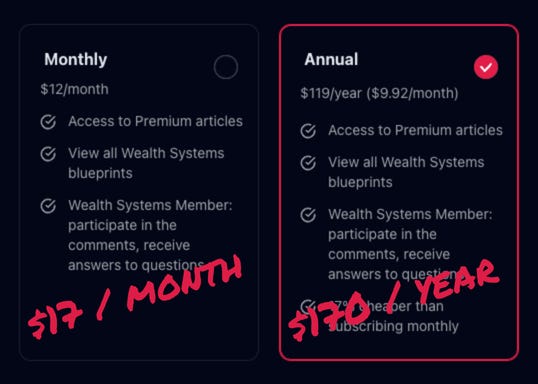

.We are raising the price on August 29, 2025. Going from $12/month to $17/month. Free posts are going to be the rare exception. Then, we are increasing price AGAIN to $22/month or $225/year on December 31, 2025. Subscribe now to lock-in today’s rate!

You have 16-days to secure the current price.

By the end of this year we will have increased price from $12 a month to $22. Lock in $12/month.

WHY AM I DOING THIS?

In December it’ll be 2-years since I began writing Wealth Systems. Over that time I’ve published 161 pieces here… that’s just over 8 posts every month. So much energy put out. What a catalog. 😉

I’ve met people IRL who built the “Dividend A Day” engine and who receive incoming transfers into their brokerage account every single day.

A new friend gleefully showed me $400K in capital sitting in an Options trading account, owing it to strategies he learned here.

Four of the 749 readers went all the way. They built their own wealth systems after reading these pieces. They took initiative, then they reached out to me. They didn’t blindly ask for help. They tried the homework, then showed me their work. I'm sure some of you looked into dividend investing or read a bit about Bitcoin because of what you read here, but a small group applied everything.

This group is now in a much different place than they were a year ago.

I’ve helped them build out a LOT. In some cases, we are partnering on projects, in every case we are learning from each other and building relationships.

The time has come for us all to build wealth systems of our own.

I love building engines, engineering risk mitigation layers and networking these engines together to build a wealth system that supports my family and our goals in life.

We’ve demonstrated covered Options writing strategies that generate yield for folks who are already receiving dividends payments on those same underlying securities. Wealth Systems spotlighted direct investing concepts that are vital to learn and build on. We’ve shared posts that highlight the fake news in money making, looked at wealth engine schematics in-depth and more.

I learned a lot from the research required to write these posts and reading the replies… but I gave away even more of myself and my time.

When you look at the final tally… not much to show for it.

To be clear: I didn’t do this to make more money. I did this because EVERYONE kept asking me “hey how do I get wealthy, what’s the secret, can you show me how your wealth engine things work?” so I started writing.

And while the readership is engaged, and growing, it’s not paying for the longer/deeper articles with actual tactical plans, nor the deep posts about strategies and mindsets to build empires, like this one:

Find, Fix, Finish

The fluorescent lights hummed, casting a blue glow on the rows of desks in front of me. The air smelled faintly of old coffee and BBQ sauce.

See, I’m trying to get everyone to take active roles in their destiny. Get a clear picture of what success means to you, help you become financially literate, organize your information, start to build your first engine, feed that energy toward the funding of a 2nd engine and integrating your engines together into a powerful wealth system.

We are dedicated to that here. The content has gotten better in recent months. We’re addressing more useful topics at greater tactical depths, the feedback from the last half dozen articles has been incredible. And well, it’s time for an evolution.

Looking for free stuff to read? I have 2 other substacks. One has 2x the audience size,

, (call that one LITS) which is focused on technology and in particular, AI.I’m going to keep LITS mostly free with monthly paid deep dives on AI research and developments. LITS has been around for nearly 3-years. It’s my oldest. My final substack is called Mastering Revenue Operations and its all about making money by operationalizing companies in more effective ways. The focus there is building powerful, reliable and resource-efficient revenue engines.

is going to be 99% paid. is going to be 95% paid. is going to be 40% paid.My biggest passion is helping people reclaim their lives through sovereign wealth. That’s the raison d'etre of this place.

To do that, the quality of my R&D and writing has to improve which means I need to invest more time + resources into learning, experimenting and developing. That means fewer posts, at higher levels and greater depths. It also means no more freebies. I’ve put out enough thought sauce for you to decide if this is a worthwhile resource to invest in.

If you see value, become a paid member of Wealth Systems to read all the articles including wealth engine schematics, and concepts from Big Tech to Wall St.

Onto today’s article.

20 Ways to Win in Tech Investing

This article is a view across all the different strategies we see deployed in the tech investing landscape.

You can win a lot of ways.

That’s part of the reason the “self-help” world is so crowded, and so divergent in opinion about what works: almost anything can work.

A Life Plan for People Who Want to Win

The first time I saw a billion-dollar balance sheet up close, it wasn’t the number that struck me.

Just because it can work doesn’t mean it was efficient to try that strategy, executed that way.

My best advice: study the moves (and the thinking) of the best achievers, then dissemble those ideas into components you use to construct your own success frameworks.

Or, just read this article. We are going to start by looking at two very different tech entrepreneurs (and investors) and then surveying the horizon of strategies and tactics.

Keep reading with a 7-day free trial

Subscribe to Wealth Systems to keep reading this post and get 7 days of free access to the full post archives.