McDonagh Family Office - 2024 Review

I am a nerd and I see science fiction becoming reality all around me. These are happy times.

What a wild year 2024 was.

The power of AI is finally being felt. Nuclear power is back. Decentralization is flowering everywhere. There is a feeling of a new renaissance here in America.

Our family office’s job is to make more money and to protect our money.

The problem is.. we are moving so fast now in terms of technological development and engineering that candidly: no business model is safe. That makes our job more difficult.

Never mind whether any single company is safe (they aren’t) or if you can find a single industry that won’t be impacted (you can’t) — entire MODELS for doing business are in the process of being invalidated.

AI agents are gaining super powers.

Soon humanoid robots will be in our homes, on our streets and inside what’s left of our offices. They will gain super powers as they iterate through development OODA loops. Just like Tesla is gobbling up factorials more data than their first few years thanks to [(rising sensor counts in Teslas) x (rising Teslas on the street)]… every single robot and every single AI agent benefits from the exploding count of automatons.

We are on the cusp of a technological renaissance, driven by the convergence of artificial intelligence, robotics, and decentralized technologies. These forces are reshaping industries, creating new opportunities, and challenging traditional business models.

In this rapidly evolving landscape, adaptability is paramount.

We are actively seeking investments in companies that are not only embracing these technological advancements but also demonstrating the agility to navigate future disruptions.

AI agents are rapidly becoming more sophisticated, capable of automating complex tasks and making intelligent decisions. Humanoid robots are poised to enter our homes and workplaces, transforming the way we live and work. This presents both challenges and opportunities for investors. Operator by OpenAI has largely invalidated the virtual assistant industry. I could see it doing the same to data analysts and even data engineers in the near future.

It’s clear that in today's rapidly evolving world technology is reshaping every aspect of our lives, including the way we invest and manage wealth.

At McDonagh Family Office, we embrace this technological revolution, leveraging its power to enhance our investment strategies and deliver superior results.

Technology is not just a tool; it's a catalyst for innovation and efficiency.

We believe that by integrating technology into our investment approach we gain a deeper understanding of markets, which has downstream implications for decision-making and risk management.

Gain a Deeper Understanding of Markets

Advanced data analytics and machine learning algorithms allow us to analyze vast amounts of market data, identify trends, and uncover hidden opportunities. This data-driven approach provides valuable insights that inform our investment decisions.

Enhance Decision-Making

Technology empowers us to make more informed and objective investment decisions. By automating routine tasks and providing real-time data visualization, we can focus on strategic analysis and portfolio optimization.

Improve Risk Management

Sophisticated risk management tools enable us to identify and mitigate potential threats to our portfolio. We use technology to monitor market volatility, assess risk exposures, and implement hedging strategies to protect our investments.

Increase Efficiency

Technology streamlines our operations, improves communication, and enhances transparency between our portfolio companies and the family office.

I’ve even built private web applications that we use internally to store documents, access due diligence portals and track portfolio company progress and developments — we even plotted their location so we can literally keep an eye on it, satellites and all!

I invested in Geoship because it solves the biggest problem in real estate: affordability. The team behind Geoship is passionate but also deeply talented with incredible industry reach, the engineering team is Ex-Tesla + Ex-Apple and other nerd badges we know and love.

Geoship homes cost just 55-60% of conventional homes - this makes home ownership accessible to a broader demographic.

Geoship's ceramic geodesic design keep material costs incredibly low. The modular triangle panels are genius, allowing for quick assembly without the need for large construction crews and all the cost and hassles that come with.

There are an endless number of mega minds (Elon, BYD / Chuanfu, Ford, Mercedes, etc..) fighting to make the next car and win the Logistics Wars... the battle in real estate tech space has fewer competitors and is more disruptable.. with a massive (worldwide massive) addressable market.

Geoship homes are fireproof, hurricane-proof and are designed for a 500-year life. The team engineered their own bioceramic material to make the beauty you see below possible.

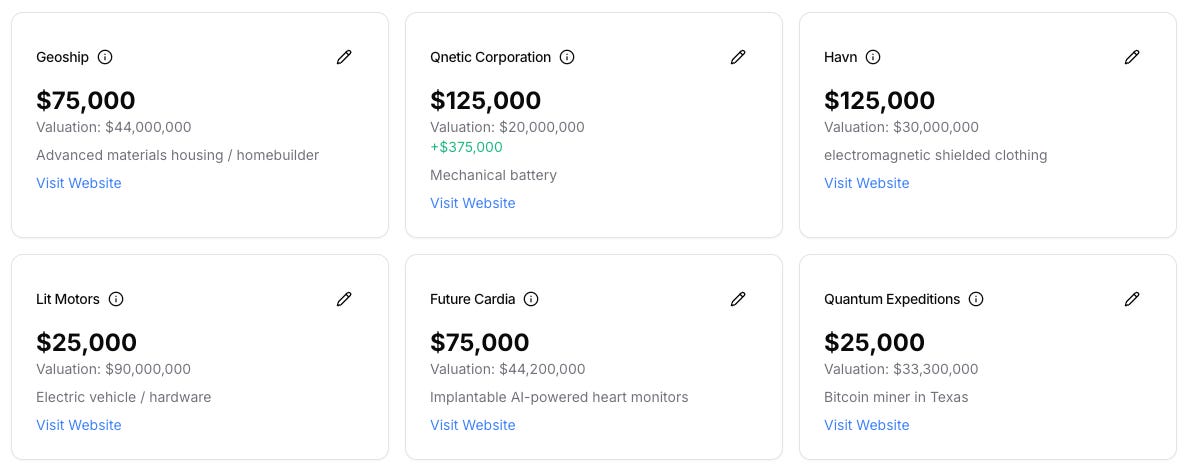

As you can see, I am very excited about Geoship and the 6 other direct investments McDonagh Family Office made in 2024.

But these investments are capital consuming, they don’t make us money early and they usually don’t make money at all. The VC investments and angel investments are very speculative and they take FOREVER to return any capital.

Our Multi-Engine Approach, Powered by Technology

Our investment philosophy is built on a "multi-engine" approach, where each engine represents a distinct strategy designed to generate consistent income, achieve capital appreciation, and preserve wealth over the long term. Technology plays a crucial role in optimizing each of these engines.

Engine One: Dividend Investing

Our core "engine" is a robust dividend portfolio, strategically structured to provide a steady flow of income. We diversify across monthly, quarterly, and annual dividend payers to ensure a consistent cash flow throughout the year. This approach smooths out income variability and provides a reliable foundation for reinvestment and growth.

Diversification Across Payout Schedules

Monthly Dividend Payers: These provide a consistent "paycheck" throughout the year, offering immediate cash flow for reinvestment or expenses.

Quarterly Dividend Payers: The majority of dividend-paying companies fall into this category. They provide larger, more impactful income boosts every three months, allowing for strategic allocation and reinvestment.

Annual Dividend Payers and Specials: These offer a "bonus" at the end of the year or on special occasions, providing opportunities for larger investments or distributions. We typically bulk buy BTC when that happens.

We utilize Dividend Reinvestment Plans (DRIPs) to maximize the compounding effect of our dividend income. By automatically reinvesting dividends, we purchase more shares, which in turn generate more dividends, creating a powerful snowball effect.

We prioritize companies with strong fundamentals, healthy payout ratios, and a history of consistent dividend increases. This selection process reduces the risk of dividend cuts and ensures the long-term sustainability of our income stream.

Nothing is perfect.

In fact, I have serious concerns about the fiat bedrock underneath the equities market, real estate market and just about every market…

Except Bitcoin.

Engine Two: Bitcoin

To complement our dividend engine, we allocate a portion of our dividend income to Bitcoin.

In fact, BTC is our primary “wealth battery”.

We view Bitcoin as a unique asset with the potential to serve as a hedge against inflation and a store of value in an increasingly uncertain economic landscape, my favorite qualities being:

Scarcity: With a fixed supply of 21 million coins, Bitcoin is inherently scarce. This scarcity, combined with growing demand, could drive its value higher over the long term.

Decentralization: Bitcoin operates independently of any central bank or government, providing a level of protection against geopolitical and monetary policy risks.

Growing Adoption: As more businesses and individuals adopt Bitcoin, its utility and value proposition increase.

We utilize a dollar-cost averaging strategy to mitigate the volatility inherent in the cryptocurrency market. By consistently investing a fixed amount at regular intervals, we average our purchase price over time, reducing the risk of buying high and selling low. We also take advantage of large capital inflows by making BTC buys.

We view Bitcoin as a long-term investment. While its price can be volatile in the short term, we believe its underlying technology and unique properties position it for significant growth over the coming decades.

I see Bitcoin as the matter to fiat’s anti-matter.

Just like matter and anti-matter have opposing properties, Bitcoin and fiat operate in fundamentally different ways. Bitcoin is decentralized and has a finite supply, while fiat is centralized and can be printed endlessly.

When matter and anti-matter meet, they annihilate each other. I expect Bitcoin to disrupt and eventually replace entire traditional fiat systems (intermediaries mostly) and I expect it to capture the monetary premium currently sloshing around the real estate and equities markets.

Bitcoin's decentralized nature directly challenges the centralized control of fiat currencies by governments and central banks. This will lead to a more democratic and transparent financial system.

Bitcoin transactions can occur directly between parties, potentially reducing the need for banks and other financial institutions. This will lower costs and increase efficiency.

Middlemen will stop getting rich acting parasitically, as well.

This isn’t about cutting people about, it’s actually the opposite. Bitcoin can be accessed by anyone with an internet connection, potentially bringing financial services to the unbanked and underbanked populations worldwide.

I am very confident of all this.

What I can’t say definitively is when this will happen - when BTC will flip Gold and gain parity with the rest of the asset classes. I can’t say when Bitcoin will become the most valuable asset in the world.

But it will.

Until then, we need to operate in the fiat confines and take advantage of all the moneymaking opportunities.

Like options. Selling them, specifically.

Engine Three: Options Trading

We utilize conservative options strategies to further enhance income generation and capitalize on market opportunities.

Our primary focus is on covered calls and cash-secured puts, which allow us to generate income while managing risk. Risk management is done across many dimensions - position sizing, mandatory stop loss orders and through proprietary means.

We sell covered calls on stocks we already own, generating premium income while potentially limiting some upside potential. This strategy is ideal for stocks we believe will trade sideways or experience moderate growth.

We sell cash-secured puts when we are bullish on a stock and willing to buy it at a lower price. This strategy allows us to generate income while potentially acquiring shares at a discount.

We prioritize risk management in all our options trading activities. We have clearly defined rules and protocols to limit potential losses and ensure that our options strategies complement our overall investment approach.

You must understand that every investment carries inherent risks. While I love collecting premiums I often need to pay out of my pocket for risk management efforts… and sometimes positions go against us entirely. We actively monitor market conditions and have protocols in place to mitigate potential downsides.

Dividend Investing: We focus on companies with strong fundamentals and sustainable dividend payout ratios. We diversify our holdings across sectors and industries to reduce concentration risk.

Bitcoin: Our dollar-cost averaging approach helps to reduce volatility risk. We also maintain secure storage practices to protect our Bitcoin holdings. We never discuss our security set-up to anyone, in any format — and neither should you!

Options Trading: We prioritize conservative strategies and have clearly defined risk management rules. We limit our exposure to options trading and continuously monitor our positions to ensure they align with our risk tolerance.

I am a nerd and I see science fiction becoming reality all around me. These are happy times.

Our family office team is excited about the future and the transformative potential of these technologies. We are committed to leveraging our expertise and resources to identify and capitalize on the most promising investment opportunities in this new era.

We are confident that our multi-engine approach will continue to deliver strong results that will be amplified by the leverage technology provides in the years to come.

Update: Thank you so much for spreading the word on social media, across finance and technology communities, in Discord/Slack and wherever else investors, builders and nerds like us gather.

Thanks to you we are getting lots of inquiries about sponsored posts, product reviews, speaking engagement opportunities and more.

Please fill out this form if you have any inquiries or collaboration ideas.

👋 Thank you for reading Wealth Systems. I started this in November 2023 to share the systems, technology, and mindsets that I encountered on Wall Street.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.