Sneak Peak: Titan Watch

See What The Insiders Are Buying

We started this journey building simple wealth systems with very basic components including automated savings & investments contributions, dividend portfolios, and more.

Now, we are getting into the AI-powered tech, by building tools of our own.

The first is called Titan Watch.

Titan Watch aggregates and visualizes high-signal data from influential figures. It functions as a hybrid analytics dashboard and a specialized CRM. A single panel of glass to see what insiders are buying, tracking the trends, the plays and the players across time.

As a BIG THANK YOU, paid subscribers will get early access and special privileges.

This tool is like a smart X-Ray for the insider trading data. It allows users to track the trades of corporate insiders, politicians and more.

For obvious reasons, investors often wish to research insider ownership to consider the extent of insiders’ economic stake in the success of the company, as reflected both in outright ownership and transactions (such as equity swaps) that may hedge the economic risk of that ownership. These investors believe that reports of insiders’ purchases and sales of company securities can provide useful information as to insiders’ views of the performance or prospects of the company.

This is where you need to apply logic. Insiders may sell company securities for any number of reasons, including for liquidity or diversification purposes… but they buy for one reason. Expected upside.

How do you get this data?

Data, Data, Data

The Government mandates quarterly reports are filed for insiders.

But the formatting is gross, there’s no context and you can’t drive an insight or analytics engine on top of it.

Titan Watch fixes that.

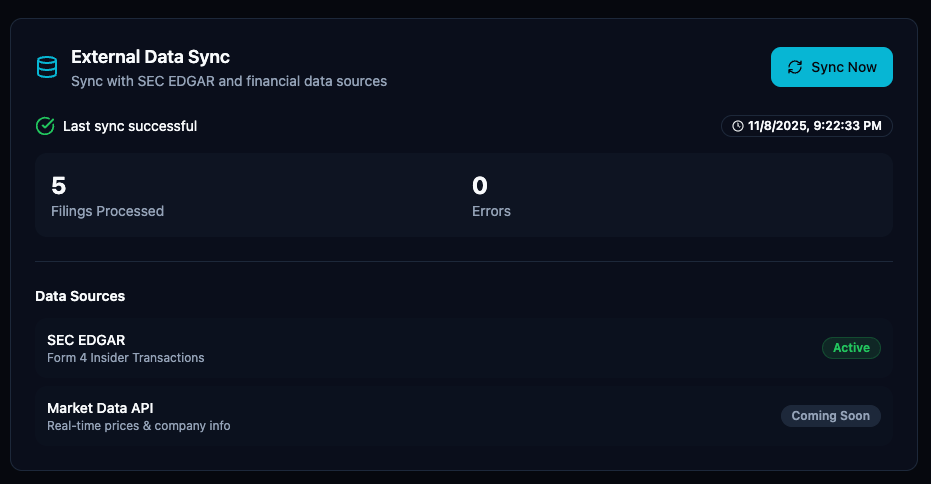

We’ve built an ingestion layer that pulls in the EDGAR data (and other data sources) and processes them in a proprietary way to make them more AI-friendly.

When a person becomes an insider (for example, when they are hired as an officer or director), they must file a Form 3 to initially disclose his or her ownership of the company’s securities. Form 3 must be filed within 10 days after the person becomes an insider.

In most cases, when an insider executes a transaction, he or she must file a Form 4. With this form filing, the public is made aware of the insider’s various transactions in company securities, including the amount purchased or sold and the price per share. Form 4 must be filed within two business days following the transaction date. Transactions in a company’s common stock as well as derivative securities, such as options, warrants, and convertible securities, are reported on the form. Each transaction is coded to indicate the nature of the transaction.

You know whats great at reading coded transactions?

AI.

The Government has many other treasure troves of data for us to feed to AI, too.

Does that mean this data is easy to get or work with?

Not even close! But, it's worth it.

Analysts are paid to issue ratings. They have no downside if they are wrong. Media pundits need engagement. They sell fear and greed. Insiders are betting their actual net worth.

That is the only signal that matters. Skin in the game.

I saw this constantly on Wall Street. CEOs would go on TV. They would tell you the company is strong. Then they would quietly dump their stock into the rally. Watch what they do. Not what they say. Words are free. Capital is expensive. When someone writes a check, they are serious.

Understand the asymmetry. Insiders sell for a dozen reasons. They need liquidity. They are buying a house. They are paying for a divorce. Selling is noisy data. It often means nothing. But insiders only buy for one reason. They know the stock is too cheap. They see the roadmap. They know the numbers before you do. They are front-running their own execution, at best.

This is “proof of work” for equity markets. It is a verifiable on-chain commitment in a fiat world. When the CFO backs up the truck and loads shares, wake up. Stop reading the breathless articles. Stop listening to the terrified herd. Look at the SEC filings. Follow the people who have the most to lose. If the insiders are all buying, the bottom is likely near.

What is Titan Watch delivering with this data?

Stay tuned.

Or better yet, sign up right now:

This is the first of several AI-powered Wealth Systems we’re publishing here.

Friends: in addition to the 17% discount for becoming annual paid members, we are excited to announce an additional 10% discount when paying with Bitcoin. Reach out to me, these discounts stack on top of each other!

👋 Thank you for reading Wealth Systems.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.