The Biggest Crash Ever

This week the Bureau of Labor Statistics will downward revise jobs for April 2023-March 2024 by up to 1 million.

Remember seeing month after month of fabulous employment data? This means that all "beat expectations" celebrated in the past year were actually misses and the US economy is in dire trouble.

Please for the sake of your financial future read that again.

The entirety of the “strong labor market” was a production. A fabrication. Outright lies designed to create cover for the Biden Harris Administration.

The situation gets demonstrably worse when you peel back what’s really happening in the labor market. Many of the jobs (the real ones they didn’t delete later I mean) are second and third jobs… not a sign of a strong economy.

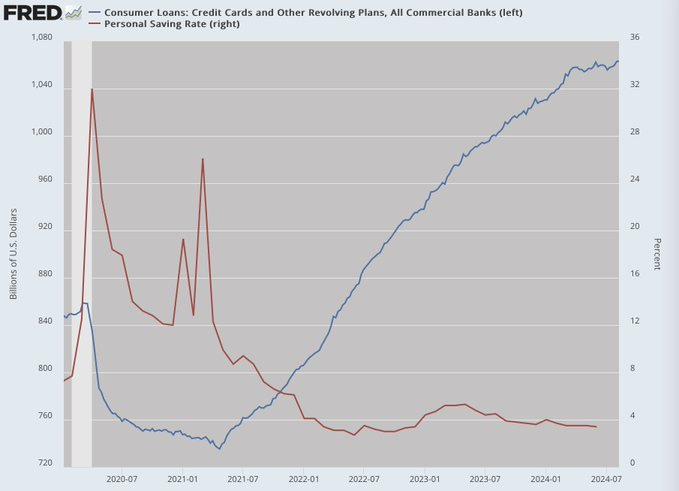

Then there’s the bleak credit card vs savings dynamic — look for yourself:

We are increasingly using credit cards to cover our rising cost of living… meanwhile this is cutting off our savings rate (the red line).

Out of necessity many have foreclosed the future …