The Moneyball Machine

The whole thing started, as these things often do, with a conversation that was going nowhere.

I was sitting in a stuffy, wood-paneled boardroom in Ohio, across from a man named Frank Stone. Frank was the CEO of a 120-person, 45-year old company that made hyper-specific iron components for heavy machinery. And my family office had just bought the place.

If “family office” makes you picture leather-bound books, trust funds, and arguments over which grandchild gets the Newport cottage, you’ve got the wrong movie. We’re first-generation. The “family” is me, my wife, and half a dozen AI agents, and the “office” is the outcome of a terrifying, exhilarating six-year sprint building a SaaS company that we sold for a number that still doesn’t feel real. The money was new. The pressure to not be the guy who builds a fortune and then blows it? That was ancient.

Frank was explaining why they’d just lost a massive contract with John Deere.

“They beat us on price” he said, slamming a thick binder on the table. “Probably using cheap Chinese steel. There’s no way they can match our quality at that price point. It’s a race to the bottom.”

I nodded. Frank was a brilliant metallurgist. He could talk for hours about tensile strength and the molecular structure of ductile iron. He believed, with the conviction of a zealot, that if you built the best product, the world would beat a path to your door. He viewed the entire commercial side of his business (sales, marketing, customer service… the good stuff) as a necessary evil. A theatrical performance of glad-handing and steak dinners that got in the way of making things.

The problem wasn’t price. Or China.

He was flying completely blind. He thought he lost on price. He had no real idea.

And that’s when I knew this was the place. Because my entire theory of the world, the very insight that led to my first success, is that most companies have no idea how they actually make money.

The sales funnel, the marketing engine, the customer relationship is a black box. Money and effort go in one end, and (if you’re lucky) more money comes out the other.

But what happens inside?

Why does one customer buy and another walk?

Why is one salesperson a superstar and another a dud? Most leaders will give you answers based on gut feel, anecdotes, and superstition.

They have no earthly idea. They’re driving a Formula 1 car by listening to the engine and guessing how fast they’re going.

During the sale of our start-up, the due diligence process was excruciating. The private equity guys tore our revenue engine apart, and I was embarrassed by how few of their questions I could answer with data. Why did our leads explode in Q2? Uh, I think we ran a promotion. What’s the true lifetime value of a customer acquired through a webinar versus a Google ad? Let me get back to you on that.

I swore then and there that if I ever got the chance to be on the other side of the table, I wouldn’t just invest capital.

I would install a goddamn nervous system.

I would build a machine to X-ray the black box. Then I would upgrade that machine to talk to me using the power of AI.

And I had just built the machine.

The Machine

Back in our sparse office in a glass tower in NYC, my "family office" team back then was, to put it mildly, unconventional. There were no Wharton MBAs. Our team was built around a computational linguist I poached from an NSA-adjacent firm that specialized in analyzing patterns in global communications. Let’s call her Lena.

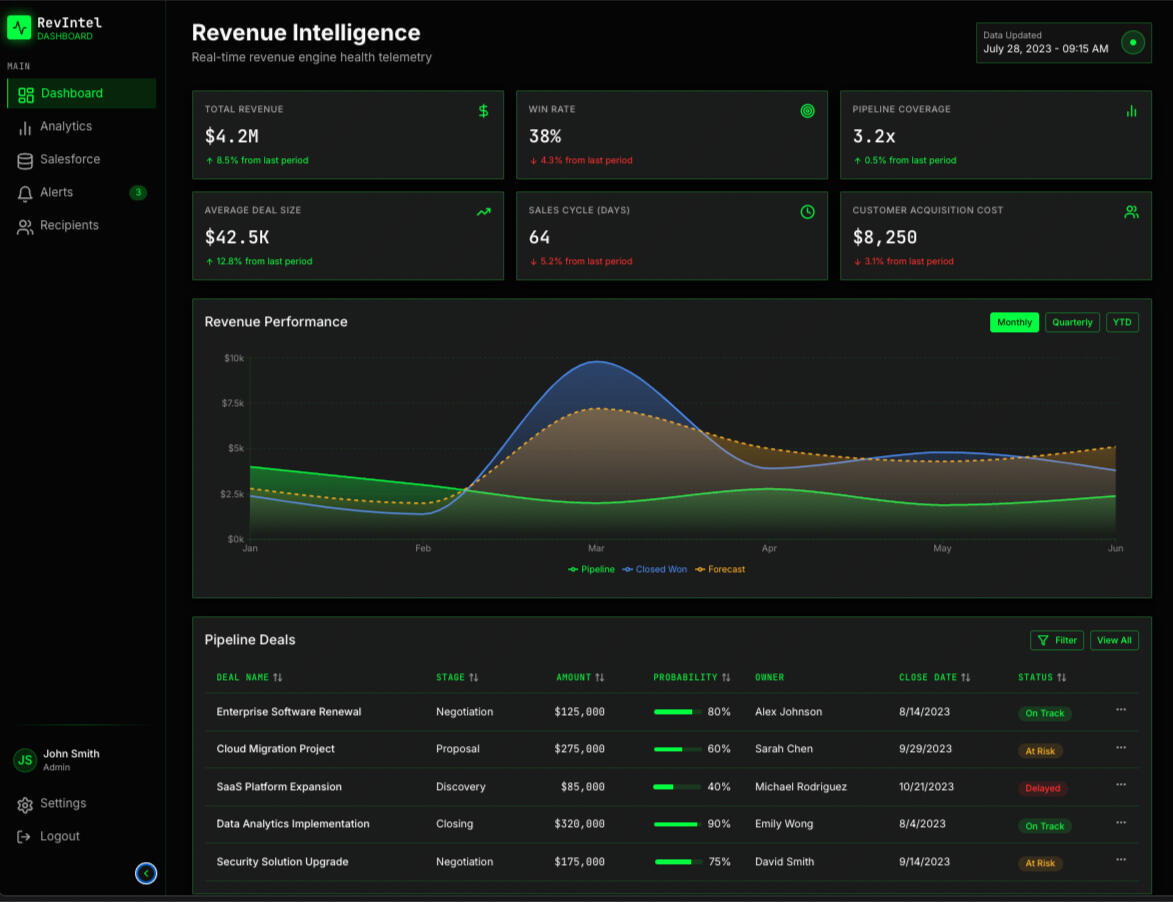

Lena and her small team built our proprietary software, codenamed "Echo" which eventually became RevSystems.

Echo was our revenue engine monitoring platform.

It wasn't a piece of code; it was a smart alarm for revenue growth. It was designed to integrate, silently and seamlessly, with the full suite of a company’s communications tools and work streams: Salesforce, Outlook, Gong, Slack, Zendesk, Marketo. It ingested every email, every call transcript, every sales note, every customer support ticket, every marketing email. It listened to the entire conversation a company was having with the outside world, across all channels and every thread.

The voice of the customer and your sales & marketing performance… all in the same place.

Its purpose was to find the patterns that no human ever could. To connect the dots between a support ticket in January, a marketing email in March, and a lost deal in June. It was my asymmetric information engine, designed not for a factory floor, but for the messy, chaotic, deeply human world of commerce.

This was going to be its first real-world test.

I flew back to Ohio with Lena. Frank took one look at her and her quiet, intense demeanor and was immediately on the defensive.

“So you’re the computer expert,” he said, hands on his hips.

“We’re not IT” Lena replied, her voice flat. “We don’t fix your printer. We plug into your company’s central nervous system and tell you what it’s thinking. Most companies don’t have a nervous system, so next step after we finish our initial analysis will be deploying sensors and refining our analytics.”

Frank just stared.

“Frank..” I jumped in, “you’re a genius at making things. Let us worry about the selling part. This is our value-add. We just need API access to your systems, your tech folk may need to make integration users but Lena will walk them through it. You won’t even know we’re here.”

He grumbled about privacy and "big brother" but he was desperate. Sales were flat, margins were shrinking, and I was the new owner. He didn’t have a choice.

For a week, Lena’s team worked from a small, windowless office they’d commandeered, their faces illuminated by the glow of their monitors. They weren’t running cables or installing sensors. They were writing scripts, authenticating keys, and building data pipelines. They were turning the firehose of the company’s chaotic commercial activity into a clean, structured stream.

Frank called them "the digital plumbers".

We went back to New York and watched the data pour in. The first reports from Echo were interesting, but not revolutionary. It confirmed their top 20% of customers generated 80% of their profit. It showed that response times for new leads were, on average, forty-eight hours too slow and if we respond faster we make more money. Useful stuff, but not a game-changer.

Then, three weeks in, Lena sent me a one-line message on Slack.

Subject: The Dave Protocol.

Body: I think we just cloned your best salesman.

I called a meeting with Frank for the following week.

We sat in that same boardroom. Frank was armed with his binders, ready to be defensive. I just put a single sheet of paper on the table in front of him.

“Frank, who is Dave S?” I asked.

He blinked. “Dave? He’s our top salesman. Has been for years. A real road warrior. The guy’s a natural. Great relationships.”

“Right. He’s a natural.” I said. “He accounts for thirty percent of your new business despite being just one of ten salespeople and only seeing 14% of the quality lead flow. You may have chalked it up to luck or personality. But it’s not. It’s a process.”

I slid the paper across the table. “Echo analyzed the transcripts and emails from every single sales cycle for the last three years. And it found a pattern. In the first conversation with a potential client, Dave consistently asks a set of five very specific questions. None of them are about our product. They’re all about the client’s end-product manufacturing process, their inventory challenges, and their capital expenditure cycles. The rest of your team leads with our specs and a price sheet. Dave leads with a diagnostic. He sells the problem before he ever mentions the solution.”

Frank stared at the list of five questions on the paper.

I went on. “Echo correlated this pattern. Lena is calling this the ‘Dave Protocol’ and it demonstrates a 40% higher closing rate and a 15% increase in average deal size. The machine reverse-engineered your best salesman’s gut instinct. It found the magic, and it wrote down the recipe.”

The room was silent. Frank picked up the piece of paper and read the questions, his lips moving silently. He wasn’t looking at me with suspicion anymore. He was looking at the paper with a kind of awe. It was the look of a man who had spent his life staring at a locked door, and someone had just handed him the key.

“You’re telling me” he said slowly, “that a computer figured this out by itself?”

“Echo didn’t figure it out if you think about it.” I said. “Dave did. Echo just listened. It did what no manager or spreadsheet ever could: it analyzed millions of words, found the winning pattern, and made it visible.”

That was the turning point. We took the Dave Protocol and turned it into a new, mandatory sales playbook. We trained the entire team. We changed their incentives. Six months later, the sales pipeline was up by nearly forty percent. Margins were improving because they were no longer leading with price. Frank was a convert. He started calling us once a week with new questions. "Can Echo tell us which customers are most likely to leave or reduce their average order amount in the next six months?" "Can Echo analyze our competitors' press releases and tell us what they're planning?"

The answer, more often than not, was yes.

We’re now deploying RevSystems across our entire portfolio. We invested in a B2B insurance brokerage. RevSystems analyzed their renewal negotiations and discovered they were losing customers not over price, but over confusing policy language, identifying specific clauses that created the most friction. They rewrote the contracts, and retention jumped.

This is the playbook.

As a first-generation office, we don’t have a hundred-year-old reputation to lean on. We have the capital from one successful sprint, and we have the scars and the lessons that came with it. Our edge isn't our money; it's our operating model. We don’t just buy companies or cut checks. We install a new brain. We give them the gift of sight.

The old world of investing was about picking the right company.

The new world is about making the company right by transforming its commercial core into an engine that is monitored, measured, and relentlessly optimized by machine intelligence. You can’t buy that off the shelf. You have to build it. It's the ultimate asymmetric advantage in a world where everyone else is still just guessing.

Friends: in addition to the 17% discount for becoming annual paid members, we are excited to announce an additional 10% discount when paying with Bitcoin. Reach out to me, these discounts stack on top of each other!

👋 Thank you for reading Wealth Systems.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.