Why Can't We All Be Insiders?

When I started out on Wall St we worked hundred-hour weeks and slept under desks. We lived on caffeine and adrenaline. But it was there that I learned the most important lesson of the financial world. The market does not move on news headlines. It moves on anticipation of liquidity and leverage changes, information known to very few.

It moves when the people who own the companies decide to move it.

Later I co-founded a hedge fund. We were not interested in the standard analyst reports. We wanted raw truth. We built machines to read financial statements. We created algorithms that could ingest a 10-K filing faster than a human could read the title page. That experience sparked a fire in me. It started my love for building technology.

I realized that software is the ultimate leverage.

For the last fifteen years I have worked in software development, corporate strategy, operations, and finance. I have spent my days using data and systems to help companies grow. My job is building powerful and reliable revenue engines. I look for efficiency. I look for the signal in the noise.

But when I looked at my own family office portfolio I saw a problem.

The tools available to individual investors are archaic. They are reactive. They show you what happened yesterday. They show you charts that everyone else is looking at. They offer you the same disconnected data that leads to average returns.

I am a first-generation family office investor. I do not have the luxury of average returns. I need an edge.

That is why I built Titan Watch.

The Unfair Advantage

The financial markets are not a level playing field.

There is a group of participants who play by a different set of rules. They are the insiders.

These are the Fortune 500 executives who run the companies. They are the board members who approve the strategy. They are the Hedge Fund managers who move billions of dollars with a single trade. They are the US Congressmen who write the regulations that make or break industries.

They are the “Smart Money”. But really, they are just the most informed.

When a CEO buys a million dollars of their own stock on the open market they are not guessing. They are not hoping the chart looks good. They know something. They know the contract was signed. They know the patent was approved. They are putting their own net worth on the line because they have conviction.

This data is public. It is required by law to be public.

Corporate officers must file Form 4s with the SEC. Institutional managers must file 13Fs. Politicians must adhere to the STOCK Act disclosures.

The problem is not availability. The problem is accessibility.

The data is buried in government databases. It is hidden in plain sight. It is messy and unstructured. It comes in different formats and at different times. Trying to track it manually is impossible. You cannot refresh the SEC EDGAR database every second of the trading day.

But a machine can.

We are living in a golden age of technology. We have the processing power to ingest millions of data points in real time. We have the cloud infrastructure to store it. We have the interface capabilities to make it beautiful.

Titan Watch is the culmination of my experience in finance and software. It is a hybrid CRM and private investor intelligence platform. It is designed to track the movements of the most informed investors in the world.

We are turning disconnected data into actionable insights.

Follow the “Smart Money”

Most people invest based on feelings.

They like a brand or they read a tweet. That is not investing. That is gambling.

Titan Watch is built on this premise: evidence. We do not care what analysts say on television. We care what insiders do with their wallets.

We track three distinct categories of Titans.

First we track Corporate Insiders. These are the officers and directors. If the CFO of a biotech company dumps their entire holding two days before a clinical trial result that is a signal. If the CEO of a manufacturing giant buys shares near a 52-week low that is a signal.

Second we track the Super Investors. These are the Hedge Fund managers and institutional titans. We watch where the whales are swimming. When Warren Buffett or Bill Ackman enters a position it changes the gravity of the stock.

Third we track the Political Class. US Congressmen and Senators have an uncanny ability to beat the market. They sit on committees that decide government spending. They know which defense contractors are getting paid. They know which pharmaceutical companies are facing scrutiny. We track their disclosures rigorously.

This is not about politics. This is about data.

When you combine these three streams you get a map of the market that looks very different from the standard view. You stop seeing tickers. You start seeing flows of influence.

Are these the smartest investors?

Probably not.

Are they acting on the best information?

How could they not be?

Live Insider Feed

The core of Titan Watch is velocity.

Information has a half-life. A Form 4 filing is valuable the second it hits the server. It is less valuable an hour later. It is worthless a week later.

We built the Live Insider Feed to solve this.

It is a real-time stream of every insider trade. We pipe directly into the regulatory databases. We parse the messy XML and HTML files instantly. We normalize the data so it makes sense.

You do not have to decipher complex codes. We tell you exactly what happened.

Elon Musk sold Tesla.

Nancy Pelosi bought Nvidia calls.

The CEO of Pfizer bought shares.

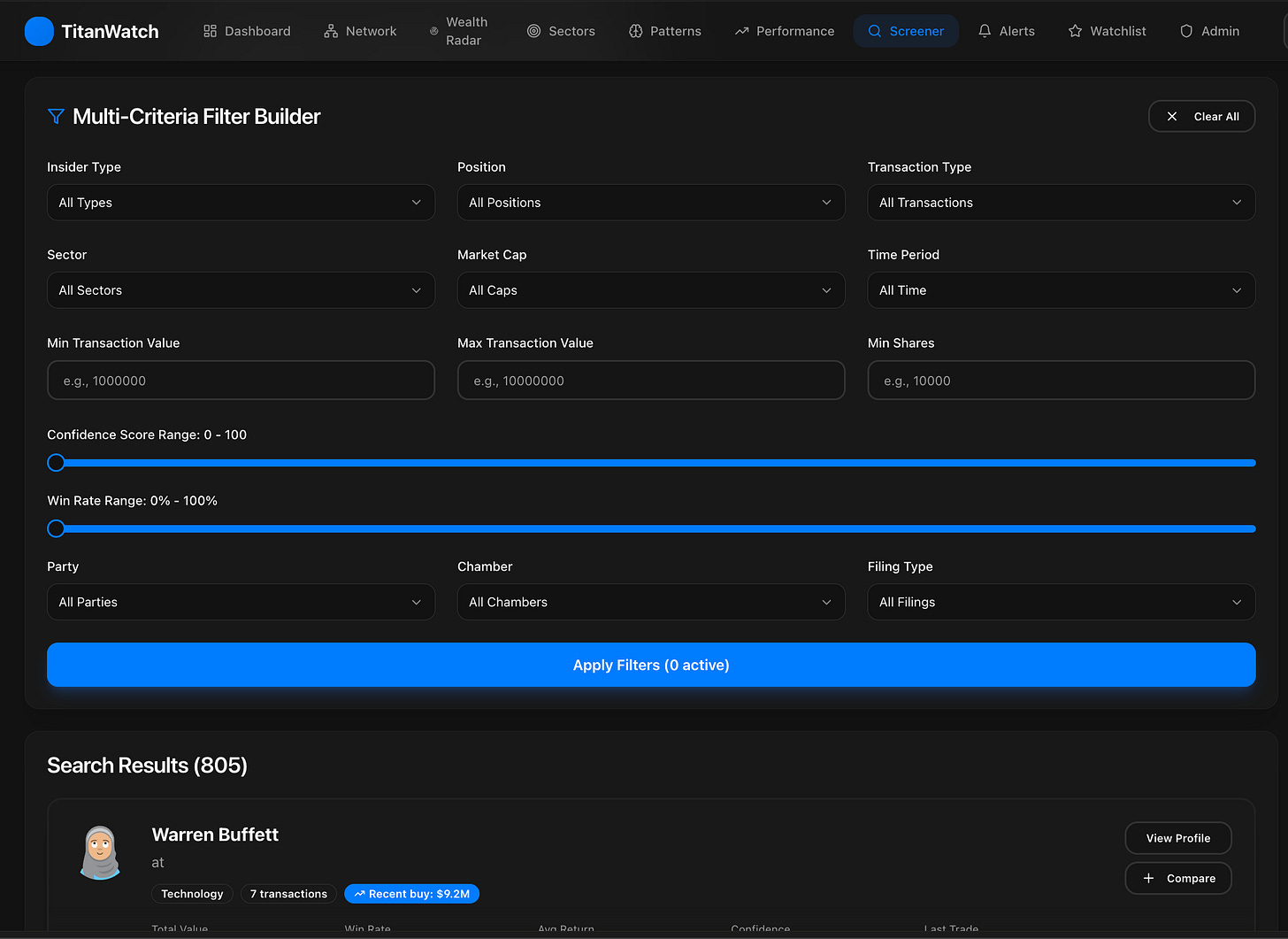

The feed is filtered and sorted to your needs. You can strip out the noise. You can ignore the small automated selling plans. You can focus only on the open market purchases. You can filter by sector or market cap.

This is the heartbeat of the platform. It is a constant pulse of what the insiders are doing right now.

In my time building revenue engines for companies I learned that real-time data is the only data that matters for operations. The same is true for trading. You cannot drive a car looking in the rearview mirror. You need to see the road ahead.

The Live Insider Feed is your windshield.

The Insider CRM

This is where Titan Watch innovates.

Most financial apps are just lists of stocks. They are asset-centric.

But markets are not made of assets. They are made of people.

I approached this with my background in Corporate Strategy and Operations. In the business world we manage our relationships with a CRM. We track our leads. We track our prospects. We log our interactions.

Why do we not do this for investing?

Titan Watch is the world’s first Insider CRM. We treat influential traders like leads. You can build your own network of “followed” Titans.

You find an investor whose style matches yours. Maybe it is a tech-focused hedge fund manager. Maybe it is a Senator who specializes in energy policy. You add them to your CRM.

Now you are tracking the person and not just the stock.

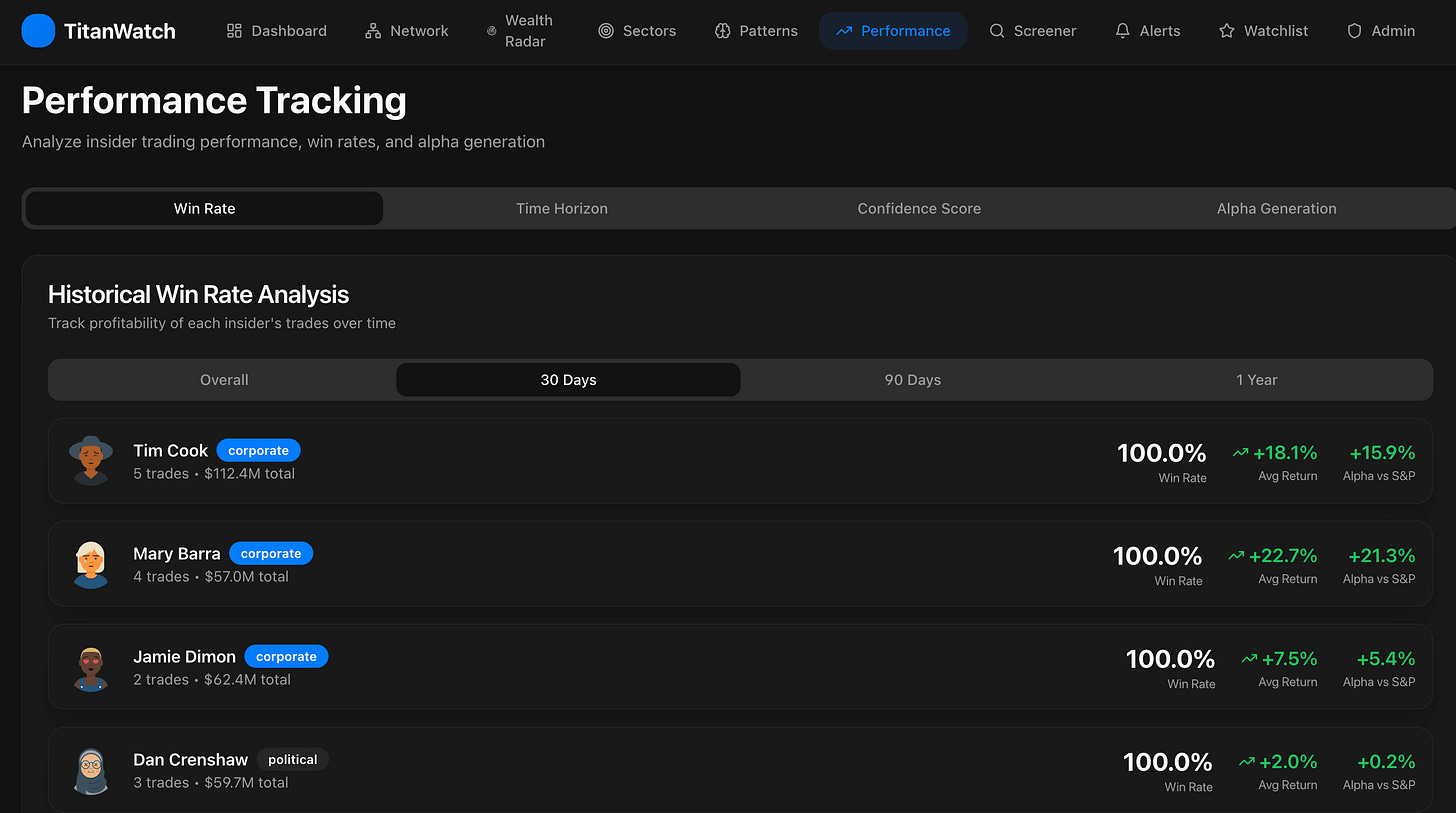

You can see their entire history. You can see their win rate. You can make notes on their profile. You can tag them.

This changes the psychology of research. You are no longer hunting for stocks. You are hunting for talent. You are looking for the people who know more than you do. You are leveraging their research departments and their insider knowledge.

This is how a family office thinks. We leverage networks. We look for partners. We copy success.

Titan Watch gives you the tools to organize that intelligence. It turns the entire market into your personal rolodex.

Wealth Radar

Data without visualization is just a spreadsheet.

I have spent years building dashboards for myself and fellow executives. I know that a CEO needs to understand the health of the business in five seconds. They do not want to read a SQL query. They want a gauge.

We built Wealth Radar to provide that same level of clarity for market trends.

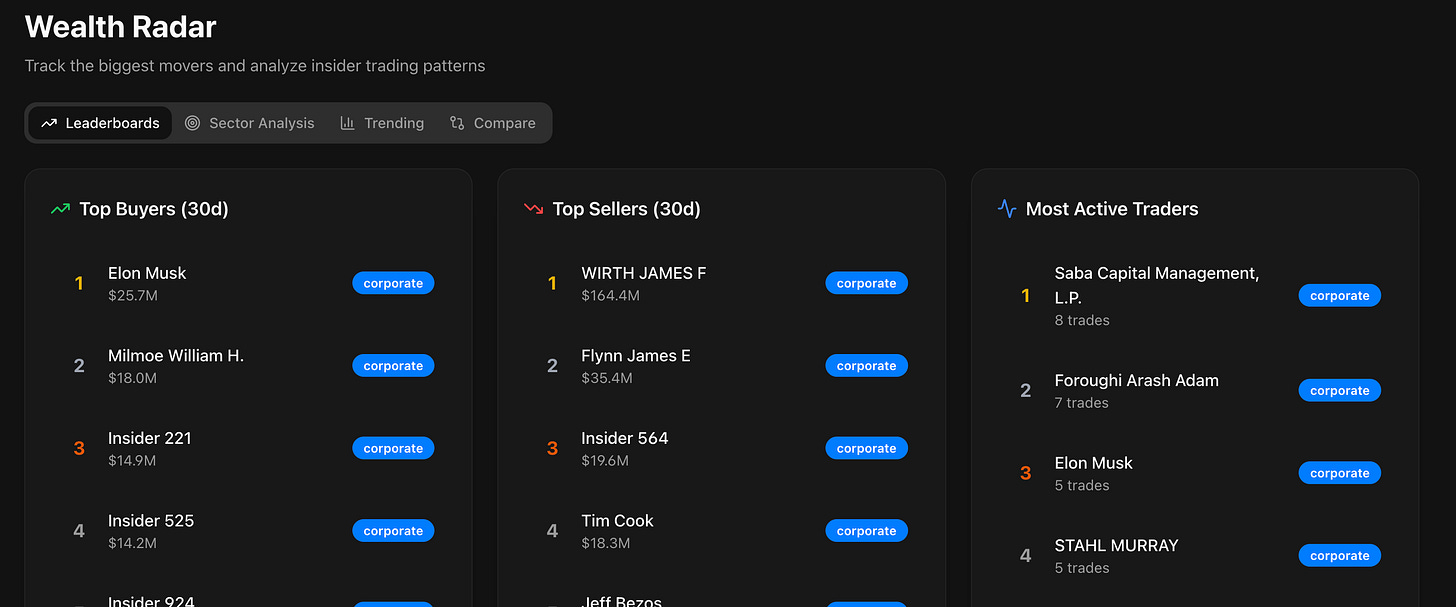

Wealth Radar is our analytics engine. It takes the millions of transactions in our database and looks for patterns. It aggregates the buying and selling pressure across sectors and industries.

It answers the big questions.

Who is buying right now? Who is selling?

We have leaderboards that rank insiders by their activity. You can see which CEO has been the most aggressive buyer of their own dip. You can see which hedge fund has the highest concentration in AI stocks.

We visualize the “Cluster Buys.” This is one of the most powerful signals in finance. It happens when multiple insiders at the same company buy stock at the same time.

One executive buying could be a fluke. Three executives buying in the same week is a statement.

Wealth Radar highlights these clusters instantly. It puts them on a map. It shows you where the conviction is highest.

We also track the divergence. We look for stocks where the price is falling but the insiders are buying. This is often the sign of a turnaround. It is the deep value play. The market hates the stock but the people running the company love it.

Wealth Radar finds these anomalies. It does the math so you do not have to.

Smart Alerts

A good system works for you. You should not work for the system.

I am a busy professional. I run a family office. I advise companies. I build software. I cannot sit in front of a terminal for eight hours a day.

I need a system that taps me on the shoulder when something matters.

We built Smart Alerts to be that tap on the shoulder.

You can configure alerts for your followed insiders. If a specific “Titan” in your CRM makes a move you get a notification. You get it on your phone. You get it in your email.

You can set alerts for specific criteria. You can ask the system to tell you whenever a CEO buys more than $500k of stock in the energy sector. You can ask to be notified if a specific politician trades a tech stock.

This allows you to disconnect. You can live your life. You can do your work. You can spend time with your family.

Titan Watch is watching the market for you.

This is the philosophy of the “Revenue Engine” applied to personal wealth. In business we build automated flows to nurture leads. We build triggers to alert sales teams. We build systems that run in the background 24/7.

Titan Watch is your wealth engine. It never sleeps. It never gets tired. It never misses a filing.

The Techno-Optimist View

I am incredibly optimistic about the future of individual investing.

For decades the game was rigged. The banks had the data. The hedge funds had the speed. The politicians had the connections. The retail investor was left with the scraps.

Technology is the great equalizer.

We are democratizing intelligence. We are taking the tools that used to cost fifty thousand dollars a year and putting them in an app. We are making the opaque transparent.

I believe in the power of data. I believe that if you give smart people access to the right information they will make smart decisions.

Titan Watch is not a magic eight ball. It does not predict the future.

It reveals the present. It reveals the actions of the people who shape the future.

When you strip away the noise and the punditry and the fear you are left with the cold hard facts of ownership. Who owns what. Who is buying more. Who is getting out.

That is the only truth in the market.

Building for the Long Term

I built this app because I needed it.

I was tired of using five different websites to track this information. I was tired of clumsy interfaces and delayed data. I wanted a professional tool.

I approached the development of Titan Watch with the same rigor I use for enterprise software. We focused on reliability. We focused on security. We focused on speed.

This is just the beginning.

We are already working on the next generation of features. We are looking at integrating sentiment analysis on top of the trade data. We are looking at mapping supply chain connections between companies to see how insider buying in one sector predicts movement in another.

We are building a platform that grows with you.

Your Invitation

If you are serious about investing you need to be serious about your data.

You cannot rely on the news. The news is written by journalists who are paid to generate clicks. It is not written by investors who are paid to generate returns.

You need to go to the source.

Titan Watch is your direct line to the source. It is your private line to the boardroom. It is your window into the portfolio of the most successful investors on the planet.

We are launching soon. I want you to be part of this.

I am inviting you to join us. I am inviting you to stop guessing and start tracking.

Build your network. Follow the smart money. Turn the disconnected data into your edge.

This is how we level the playing field. This is how we win.

Welcome to Titan Watch.

Friends: in addition to the 17% discount for becoming annual paid members, we are excited to announce an additional 10% discount when paying with Bitcoin. Reach out to me, these discounts stack on top of each other!

👋 Thank you for reading Wealth Systems.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.