Post-Scarcity: Where Are We Going?

Maps for a New Continent

We are trying to navigate a new continent using maps drawn last century.

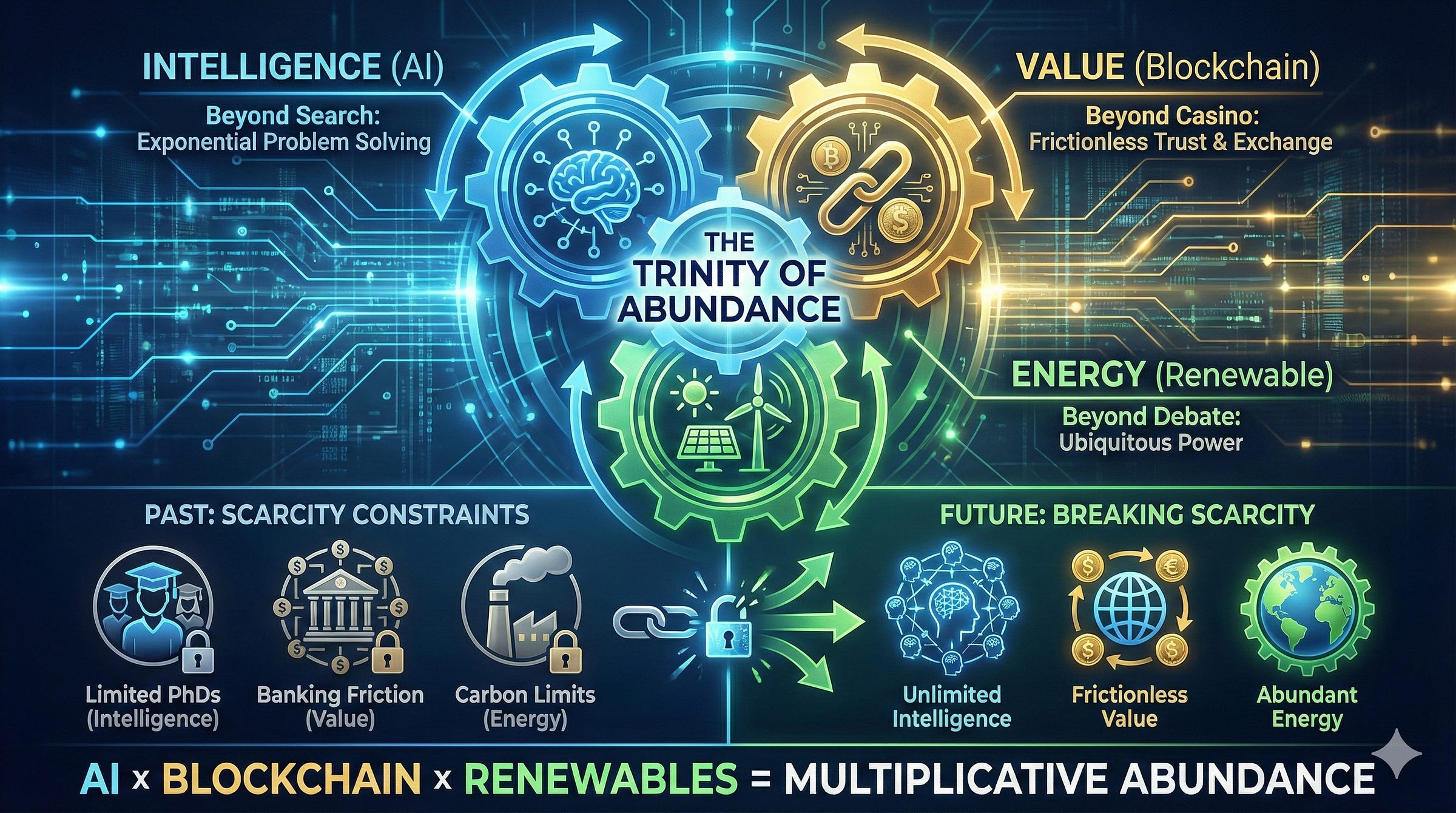

We look at Artificial Intelligence and we see a better search engine. We look at Blockchain and we see a digital casino. We look at renewable energy and we see a political debate.

We are missing the picture because we are looking at the pieces in isolation.

These are not three separate industries. They are three gears in a single system.

The Convergence

They are the Trinity of Abundance.

Intelligence

Value

Energy

For the last century these three fundamental inputs were scarce. Intelligence was limited by the number of PhDs we could train. Value was limited by the friction of the banking system. Energy was limited by how much carbon we could burn.

We are about to break the scarcity constraint on all three at the exact same time.

This is not an additive change. It is a multiplicative one.

Value

Let’s start with the friction.

Imagine an AI agent in 2027. It is a piece of software tasked with optimizing your supply chain. It ident…