Upgrading the Options Machine

Wealth Engines Rarely Offer Leverage and Income

Let’s get into more advanced tactics now.

Part I provided the basic blueprint for an options machine.

We built the foundation. We built the chassis. We discussed The Wheel.

We discussed the extraction of yield from high-quality assets via Cash-Secured Puts and Covered Calls.

This is a valid strategy.

It is robust.

It is safe.

It is the strategy of the Fortress.

But there is a problem.

The Wheel is heavy. It is capital inefficient. It requires you to lock up massive amounts of cash to secure your downside. If you are writing a put on a stock trading at $200, you need $20,000 in cash sitting in your account, doing nothing, just to act as a backstop.

That is Dead Capital.

Dead Capital is a sin.

It is friction. It is drag on the engine.

If you want to move from Wealth Preservation to Wealth Acceleration, you cannot let $20,000 sit idle to generate $200.

The Return on Equity is too low.

The torque is insufficient. You need leverage. Not the reckless leverage of the gambler who borrows on margin to buy Dogecoin.

I am talking about Structural Leverage.

I am talking about Hydraulics.

Today, we upgrade the machine. We move from The Wheel to The Spread.

Module 1: The Physics of Financial Leverage

To understand why we use spreads, you must understand the equation of efficiency.

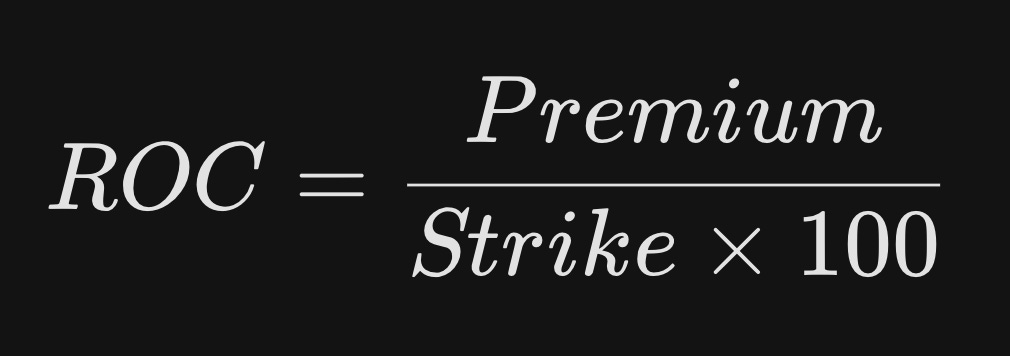

In the Cash-Secured Put (The Wheel), your Return on Capita looks like this:

The denominator is huge. It is the full cost of the shares.

In a Credit Spread, we fundamentally alter the physics in the account.

We change the denominator.

We do not just sell an option. We sell one, and we buy another.

We sell the risk, and then we buy a “disaster policy” against that risk. By buying that policy, we cap our maximum loss.

Because our risk is capped, the broker does not require us to hold $20,000 in collateral…

They only require us to hold the difference between the strike prices.

This collapses the denominator. When the denominator shrinks, the Yield explodes.

The Example: Stock X is trading at $100.

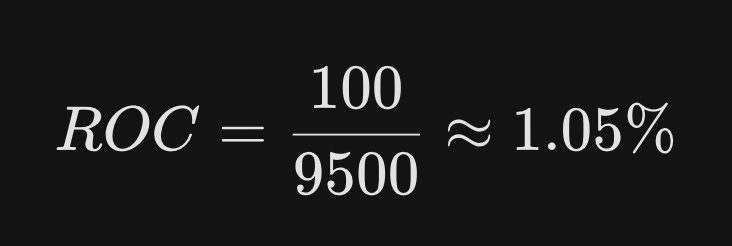

The Wheel Approach: You sell the $95 Put. Premium Received: $100. Capital Required: $9,500.

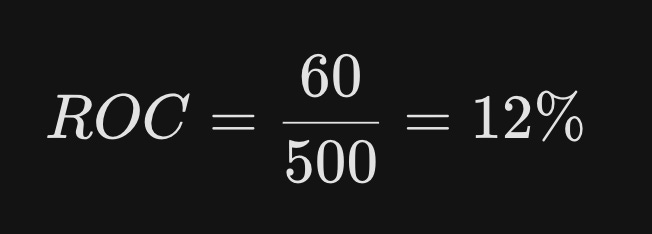

The Credit Spread Approach: You sell the $95 Put (Income). You buy the $90 Put (Protection). Cost of Protection: $40. Net Premium Received: $60 ($100 - $40).

Now, look at the capital requirement.

Your risk is defined. The stock can go to zero, but you can sell at $90.

You are only on the hook for the $5 gap between $95 and $90.

Capital Required: $500 ($5 width x 100 shares).

Same stock. Same duration. Same market conditions.

But the efficiency has increased by a factor of 10.

These are the financial hydraulics you expect in a good wealth system. A small amount of force (Capital) moves a massive object (Returns).

Module 2: The Blueprint of the Spread

We are building a business, not making a one-off trade.

And this business sells two products. Here’s how to make each of them.