Why AI and Robotics Are About to Break the Economic Model

Disinflationary Boom Like Never Before

Our economic reality is changing faster than society is.

I spent the first part of my career on Wall Street.

It was the classic path. I started in investment banking and learned the grinding mechanics of capital markets. I moved to the buy-side and co-founded a hedge fund. That was where the world really opened up for me.

We weren’t just picking stocks. We were building systems. We built software to machine-read financial statements and ingest massive amounts of data to find the signal in the noise.

That experience did two things.

First, it made me fall in love with building technology. It pushed me into a fifteen-year journey through software development, corporate strategy, and operations.

Second, it taught me that the economy is just a system. It is a massive, complex, noisy machine with inputs and outputs. If you understand the inputs, you can predict the outputs.

Most people look at the economic machine right now and see disaster. They see debt. They see demographic collapse. They see sticky inflation.

I see something else entirely.

I look at the data, the systems, and the rate of technological change, and I see the setup for the most significant economic event of our lifetimes.

We are about to enter a Disinflationary Boom.

Don’t ask ChatGPT what that means. I’ve got you AND I’ve got stories.

This is not a term you hear often. It sounds like a contradiction. We are taught that booms cause inflation. We are taught that growth comes with a price tag of higher costs.

That is the old model. That is the model based on human limitations.

My thesis for

is simple: systems are the key to success. Artificial Intelligence is going to ignite the largest disinflationary boom across the economic system in human history. Robotics is going to accelerate it. I talk about this every week on .We are not heading for a recession.

We are heading for a renaissance.

The Holy Grail of Economics

To understand why I am so bullish, you have to understand the mechanics of a disinflationary boom.

It is the Goldilocks state of economics. It is a rare scenario where an economy experiences robust, aggressive growth while the rate of inflation flatlines or falls.

Economy grows, prices don’t.

This defies the standard logic.

If you took Economics 101, you learned about the Phillips Curve. It suggests a trade-off. It says that if you want high growth and low unemployment, you have to accept higher inflation. If you want to kill inflation, you have to crush growth and increase unemployment.

That is true in a closed system.

But it is only true when you are operating within a fixed technological paradigm.

When you break the paradigm, you break the curve.

You have to distinguish between two types of economic drivers.

The first is the Demand-Side driver. This is what we saw after the pandemic. The government printed trillions of dollars. People wanted to buy things. Demand skyrocketed. But the factories and ports could not keep up.

When everyone wants to buy things but you cannot make them fast enough, businesses raise prices. You get growth, sure. But you also get inflation. That is an Inflationary Boom. It feels good for a moment, and then it hurts.

Candy for breakfast.

The second driver is the Supply-Side driver. This is the secret sauce. This is a hearty meal that makes you grow big and strong.

This happens when businesses become vastly more efficient at making things. This is a positive supply shock. It is a sudden, massive improvement in productivity or capacity that lowers the cost of production.

When you have a positive supply shock, you can produce more goods for less money. You can sell more. You can pay your workers more. And yet, prices drop.

That is the Disinflationary Boom. It is growth without the penalty.

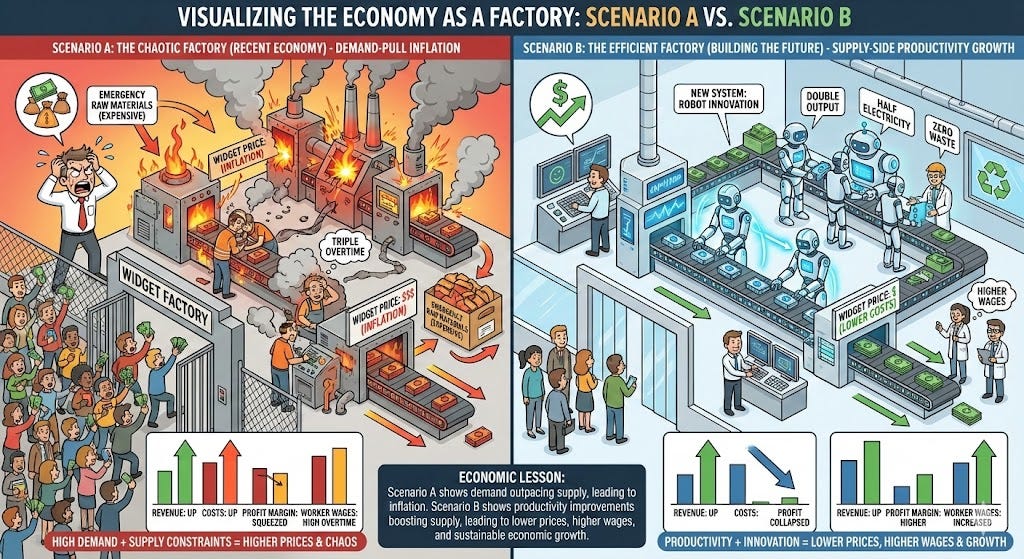

Visualizing the Factory

I like to visualize the economy as a single factory.

Imagine a factory that makes widgets.

In Scenario A, a thousand new customers show up at the gate. They are waving cash. They all want widgets right now.

The factory manager panics. He runs the machines overtime. They break down. He pays his workers triple overtime to stay late. He has to source raw materials from expensive emergency suppliers.

To cover all this chaos, he raises the price of the widget.

The factory is growing. Revenue is up. But the widgets are more expensive. That is the economy we have been living in for the last few years.

Now imagine Scenario B.

The customers are there. But this time, the factory manager installs a new system. He invents a robot that makes widgets twice as fast. It uses half the electricity. It wastes zero raw materials.

He can now produce double the output. His costs per unit have collapsed.

He can sell the widgets for less money and still make a higher profit margin. He can pay his engineers more to maintain the robots. The customers get cheaper goods. The factory gets more profit. The workers get higher wages.

That is the economy we are building right now.

The amazing one on the right.

History Rhymes

This is not theoretical. We have seen this happen before. Several times in fact.

A disinflationary boom is rare, but when it happens, it defines a generation.

Look at the Roaring Twenties in the United States.

This is the classic textbook example. Before the 1920s, factories ran on steam engines. A steam engine is a centralized power source. You had to organize your entire factory around a giant driveshaft. It was inefficient and dangerous.

Then came widespread electrification.

Suddenly, you could put a small electric motor on every single machine. You could organize the factory floor based on the workflow, not the power source.

Then Henry Ford perfected the assembly line.

Think about the union of electricity x assembly lines popping up everywhere.

Productivity skyrocketed. The output of the American worker exploded. The economy grew at a wild pace.

But here is the key. Inflation did not spike. In fact, prices for many goods fell. The cost of a Model T dropped every single year. The economy grew because things were getting cheaper and easier to make.

The driver was electrification and mass production.

Flash in the pan? No.

We saw it again in the late 1990s.

The Dot-Com era was not just a stock bubble. It was a real productivity boom.

The internet revolution made communication instant. It made data processing cheap. It allowed companies to coordinate global supply chains in real time.

The US economy grew at a breakneck pace. We saw GDP growth numbers exceeding 4 and 5 percent. By traditional logic, inflation should have been running hot.

But it remained surprisingly tame.

Why? Because technology was crushing the cost of doing business. The driver was Information Technology and the Internet.

In both cases, a structural technology shift broke the trade-off between growth and inflation.

Inflation would have been even more tame if the central banks across the world weren’t also busy printing endless money, but that’s a different albeit related matter.

Why Central Banks Can’t Save Us

The problem we have today is that our leaders are trying to solve a supply problem with demand tools.

Most central banks and governments manage the economy using the demand side. They raise interest rates to kill demand. They lower interest rates to boost demand. They print money to stimulate spending.

These are blunt instruments built to kick the can down the road.

The Fed cannot print a more efficient factory. The European Central Bank cannot lower interest rates to invent a better fusion reactor.

Monetary policy can only trade inflation for growth. It cannot give you both.

A disinflationary boom requires structural change. It requires innovation. It requires deregulation. It requires a fundamental shift in how we convert raw materials into value.

These changes are harder to engineer. They do not happen in a quarterly meeting at the Federal Reserve. They happen in garages. They happen in research labs. They happen when someone writes code that replaces a thousand hours of manual labor.

This is why I am a techno-optimist.

I spent fifteen years in operations and strategy. I help companies build revenue engines. I look for leverage.

I have never seen leverage like what is coming down the pipeline right now.

The Master Technology

We are witnessing the rise of Artificial Intelligence.

People compare AI to the internet or to the smartphone. I think those comparisons are too small.

The internet allowed us to move information omnidirectionally. The smartphone allowed us to access that information anywhere.

AI is different. AI is the ability to generate new information.

For the first time in history, our accumulated knowledge is able to generate more knowledge.

Think about the scientific method. It is a loop. You observe. You hypothesize. You test. You learn.

Until now, humans had to do every step of that loop. We are slow. We need to sleep. We have cognitive biases. We are bad at processing high-dimensional data.

AI does not have those limits.

I remember when we built that hedge fund system to read financial statements. It was crude. It looked for keywords and sentiment. It was a pattern matching engine.

Today, AI is not just matching patterns. It is reasoning.

We are seeing AI accelerate discovery across every field of hard science.

Look at material science. We have been trying to find better battery materials for decades. It is a slow process of trial and error.

DeepMind and other AI labs are now simulating millions of potential material structures. They are finding candidates for superconductors and super-batteries in a fraction of the time it would take a human lab.

Look at energy. Controlling the plasma in a nuclear fusion reactor is incredibly difficult. It is a chaotic system. AI is now being used to manage that instability in real time. It is bringing us closer to infinite, clean energy.

Look at biology. AlphaFold solved the protein folding problem. This was a grand challenge of biology for fifty years. AI solved it. Now we are using that data to design drugs that are cheaper and more effective.

This is recursive.

AI helps us build better chips. Those chips run better AI. That better AI helps us discover better materials. Those materials help us build better energy systems. Those energy systems power the data centers.

It is a flywheel of intelligence.

This creates a massive deflationary pressure.

Intelligence is an input cost for everything. Every product you buy has a cost of intelligence baked into it. The design. The logistics. The marketing. The legal work. The management.

When the marginal cost of intelligence trends toward zero, the cost of everything drops.

The Accelerator: Robotics

If AI is the brain, Robotics is the body.

This is the piece that many pure software investors miss.

We live in the physical world. We eat food. We live in houses. We drive cars. We wear clothes.

You cannot eat software.

For AI to truly drive a disinflationary boom, it has to touch the physical world. It has to move atoms.

That is where robotics comes in.

For a long time, robots were dumb. They were great at doing exactly the same thing over and over again in a controlled environment. If you moved the car part one inch to the left, the robot would weld the air.

That has changed.

AI has given robots eyes and brains.

We are seeing the rapid deployment of general-purpose robots. Humanoid robots that can walk into a factory, look around, and start working.

This is the bridge.

Robotics brings the disinflationary power of AI into the construction site. Into the warehouse. Into the farm. Into the mine.

Think about the cost of housing.

Why is housing so expensive? It is not just the land. It is the labor. It is the materials. It is the regulation.

Imagine a world where AI designs the house to be perfectly structurally optimized, using 30 percent less material. Then, a team of robots frames the house in two days. They work twenty-four hours a day. They do not get injured. They do not need breaks.

The cost of construction collapses.

This creates incredible leverage in our economy.

When you combine AI (infinite cognitive labor) with Robotics (near-infinite physical labor), you break the link between production and human time.

Currently, our GDP is capped by the number of hours humans can work. We have a shrinking workforce. We have an aging population.

In the old model, that means stagnation and inflation.

In the new model, the workforce is digital and mechanical. It can expand infinitely.

The New Business Models

This shift is going to open up entirely new business models.

When I work with companies on their revenue engines, we always hit constraints. We hit the constraint of hiring. We hit the constraint of margin.

There are thousands of business ideas that are currently impossible because the unit economics do not work.

It is too expensive to offer personalized tutoring to every child. It is too expensive to have a personal chef for every family. It is too expensive to clean the oceans.

But what happens when the cost of intelligence and labor drops by 99.999999 percent?

Suddenly, the impossible becomes commercially profitable. Which means it is guaranteed to happen quickly.

I will do it if you wont.

We will see a boom in personalized services. We will see a boom in custom manufacturing. We will see a boom in environmental restoration.

These are not just “nice to have” things. They are massive industries that simply do not exist yet because the price point is wrong.

This is the essence of the supply-side boom. You do not just make the existing things cheaper.

You make new things possible.

The Deflationary Mindset

As an investor, you have to shift your mindset.

For the last forty years, the winning strategy was to bet on scarcity. You bought real estate in prime locations. You bought monopolies. You bought things that were hard to replicate.

The winning strategy for the next twenty years is to bet on abundance.

You want to own the systems that create the abundance. You want to own the companies that are building the revenue engines of the future.

This is why I focus on data and systems.

The companies that win will be the ones that can integrate AI and robotics into their operations the fastest. They will be the ones that can take this new leverage and turn it into value.

It is not enough to just buy the chip stocks. You have to look at who is using the chips.

Who is using AI to revolutionize logistics? Who is using robotics to change agriculture? Who is using machine learning to reinvent drug discovery?

Those are the wealth systems of tomorrow.

The Transition Pain

I am a techno-optimist, but I am not blind.

This transition will be volatile.

We are talking about a fundamental restructuring of the labor market. We are talking about the obsolescence of entire industries.

There will be winners and losers.

The “Inflationary Boom” mindset is hard to break. Governments will fight this. They will try to protect the old jobs. They will try to regulate the new efficiency out of existence.

There will be panic. There will be noise, including the violent throttling-up of the money printer.

But the gravity of technology is too strong. You cannot legislate away a 10x improvement in productivity.

The capital will flow to the efficiency.

The systems that work will outcompete the systems that do not.

The Wealth System

I started this publication to talk about Wealth Systems.

A wealth system is not just a bank account. It is a structure that captures value.

The old wealth system was based on hoarding. It was based on protecting what you had from inflation.

The new wealth system is based on creation.

We are standing on the edge of the greatest expansion of human capacity in history.

We have the tools to solve the energy crisis. We have the tools to solve the labor shortage. We have the tools to cure diseases.

And we have the tools to do it all while lowering the cost of living for everyone on the planet.

This is the Disinflationary Boom.

It is driven by supply, not demand. It is powered by silicon and steel, not printing presses.

It is coming fast.

The factory is getting an upgrade.

If you are betting against it, you are betting against human ingenuity. You are betting against the one force that has consistently improved the human condition for ten thousand years.

I’m betting on the boom.

I’m betting on the system.

Let’s get to work. Reach out to me if you agree.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.