Why The US Debt & Equities Markets Are Dying

The average American has trouble paying their bills each month.

They don’t have enough saved.

What little they do have saved is losing purchasing power from inflation… at historic rates. Much faster than the savings contribution rate.

Suddenly, the American consumer is trapped in a room with limited air and rising temperature…

To make matters worse: consumer debt levels have reached all-time highs, with rising interest rates promising to suck what little air remains out of the room.

You might hear these notes whenever someone is trying to make the “economy is healthy” pitch:

look how low the unemployment rate is!

look at the all-time highs in the stock market!

The unemployment rate is low for two reasons:

many folks have given up even trying to find work, removing them from the calculation

many folks had to get multiple jobs to survive

Suddenly the message this signal is sending looks different.

How about the stock market near all-time highs?

While the markets are flying upward (at the time of writing) the price action is focused in 7 names primarily - all in technology. Extremely concentrated. NVIDIA is driving a large share of that by itself.

The concentration doesn’t stop there.

The share of the stock market owned by the top 10% (and top 1%) is at an all-time high— so even though the stock market is flying, it isn’t translating into wealth building energy for working class families.

It’s the Elite, who are also the Central Banking class, firing up the printers and inflating asset values. They cannot get their hands at the cash underneath old ladies’ mattresses, but they absolutely can devalue the purchasing power of that cash, and transfer the energy to themselves as the asset holders.

As if that weren’t bad enough, the problems in the US Markets aren’t entirely attributed to capital supply mismanagement…

Real estate is also a source of pain.

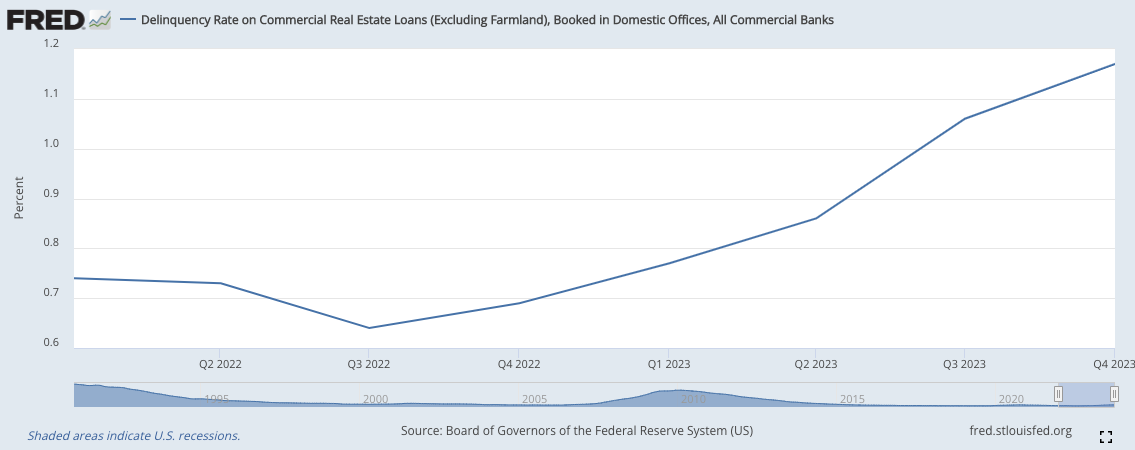

Commercial real estate delinquencies are rising.

Why does this matter, really?

Well look at who owns the debt.

Regional banks. Not the mega banks with access to “To Big To Fail” implied protection… these regional banks have critical loans to local small and medium-sized businesses including credit facilities that power payrolls.

Incredibly, a recent study from the National Bureau of Economic Research estimated that 385 American banks could fail over commercial real estate loans alone.

Mortgages, credit cards and other debt exposures not included in this analysis.

We live in a financialized and virtualized world, where banks fund payroll, and the purchase of supplies… and a lot else.

The reckless monetary policies of central banks, coupled with unsustainable debt levels across the global economy, are creating a recipe for a devastating financial crisis, leading to the devaluation of savings and erosion of trust in traditional institutions.

Despite appearances of a booming stock market, the benefits of quantitative easing are accruing to a small percentage of investors, exacerbating wealth inequality while simultaneously creating the conditions for a devastating market crash that will impact everyone.

Quantitative easing programs have created a dangerously overinflated market, vulnerable to a chain-reaction collapse triggered by systemic risks like commercial real estate debt and changes in investor confidence. A severe and prolonged stock market crash can cause widespread panic, loss of wealth, reduced consumer spending, and a significant slowdown in investment and business activity.

The apparent health of the stock market obscures the growing disparity between the wealthy elite and ordinary investors, as well as the unsustainable asset bubble fueled by quantitative easing that threatens widespread economic damage.

But wait, there’s more.

The US National Debt has reached unprecedented levels on the back of manic spending. Continuous borrowing with no clear fiscal plan to pay off this debt would lead to investor distrust, higher interest rates, and an inability to fund critical government programs.

A US default on its debt obligations would trigger a global economic catastrophe. Trust in the US dollar and Treasury bonds would erode, leading to skyrocketing interest rates and international market panic.

All of the critical systems are interlinked, and at risk.

I have theories about where the “energy” will go as the US Markets destabilize in the future:

Buckle Up: Fiat Currency Collapse Fuels Bitcoin Explosion

Wall Street didn't prepare me for this. Sure, I saw cracks forming in the financial world. Years of analyzing balance sheets with AI-powered tools gave me an edge. I could spot companies leveraged to the hilt or those playing fast and loose with accounting rules way before others did.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.