What If The Fake Money Thing Explodes?

It’s a funny thing, a monetary transition.

You only get one every five millennia or so, if you’re lucky. Imagine a front-row seat to watch the tectonic plates of civilization grind against each other. From the outside, it’s all earthquakes and volcanoes.

But if you know where to look, if you find the right people, you can spot the hairline fracture where the new continent is being born.

The story of this fissure doesn’t start in a treasury department or a central bank. It doesn’t start with a pinstriped suit or a PhD in economics from the University of Chicago.

It starts with a ghost. A ghost who wrote a book.

Not Worth The Paper It’s Printed On

Let’s talk about books.

It’s the only way for me to make sense of this mess.

On one side, you have the system we all grew up with. Let’s call it the Fiat Library. This isn't some grand, marble-columned institution. Think of it more like a global franchise of those rickety, pop-up bookshops you see in dying malls. The shelves are overflowing, groaning under the weight of trillions of volumes, each one a sequel to the last. The authors are locked in a back room, manically operating a printing press. The authors are a committee of grim-faced men and women who call themselves central bankers.

Their problem is that the story they’re telling has lost the plot. A long time ago, it was a simple, compelling narrative: a dollar is a dollar.

But then they started adding chapters.

And subplots.

And footnotes.

They’d run into a problem, a recession, a war, a pandemic, and their only solution was to print a new addendum. Quantitative Easing: The Lost Chapters. Stimulus: A Supplemental Tale. The paper they use is cheap, acidic stuff, like a receipt from a gas station. The ink is watery. You can barely get through a chapter before the words start to fade and the paper begins to curl and yellow, turning to dust in your hands. It's the Chinese Goods of monetary technology: a vast, cheap, and ultimately disposable collection of noise.

The authors are in a panic. They know the story is becoming meaningless, but their only tool is the printing press. So they keep printing. They dilute the story with every new page, shouting over the din of the press that the story is actually more valuable now because there’s just so much more of it. Look at all this paper! It must be worth something!

This is the library of noise and deferred pain. Panicked rewrites and flimsy promises printed on rotting paper.

And then, on the other side of the street, there’s a small, quiet building. It looks more like a vault than a library. Inside, there is only one book.

It’s a strange-looking thing. Bound in something that feels less like leather and more like crystallized mathematics. It has a title, but it’s just a string of letters and numbers. Most people call it Bitcoin.

This book is different. It’s absolute. For starters, it has a known ending. The author, the ghost who called himself Satoshi Nakamoto, wrote the first page, set the rules for every subsequent page, and then vanished.

Off the face of the Earth, like a ghost.

He decreed that there would only ever be 21 million copies of this book in existence, ever. He didn't just promise this, he built the rule into the fiber of the book itself and then, for good measure, he threw away the key to the printing press. It wasn't just a promise, it was a physical constant, like the speed of light.

You can’t argue with the speed of light.

The Book Opens

The first people to find the book were, of course, the weirdos. The cypherpunks. The kind of guys who had been thinking about digital scarcity since the days of dial-up modems. They weren’t looking for a get-rich-quick scheme. They were looking for a signal.

They were living inside the library of noise, deafened by the roar of the printing presses, and they were desperate for a single, clear tone.

They found it on a niche cryptography mailing list in late 2008. A nine-page white paper. It was dense, elegant, and utterly audacious. It proposed a system for “peer-to-peer electronic cash.” But what it really was, was the blueprint for the book.

A book that wrote itself, without an author.

A story that verified itself, without a publisher.

Here’s how it worked, and you have to appreciate the sheer, beautiful insanity of it. To add a new page, they called it a block, to the book, you had to solve an incredibly difficult mathematical puzzle. It was like a global Sudoku competition where the puzzle got harder the more people tried to solve it. The first person to solve it got to write the next page of transactions and was rewarded with a few brand-new copies of the book for their trouble.

This process is called mining. It isn’t mining in the physical sense; it is mining for cryptographic truth. It requires immense computational power, which means it required real-world energy. You can’t just create a new page out of thin air, the way the authors of the Fiat Library did. You have to prove you’ve done the work. You have to burn electricity. You have to tether the book’s story to the laws of thermodynamics.

It was the most ridiculous, over-engineered, and utterly brilliant idea anyone had ever had. It turned electricity into immutable truth.

And the first sentence of the first page?

The one the ghost wrote himself? It wasn't "Once upon a time" that would not align with the ultimate aim of BTC. Instead, it was a timestamp and a headline from that day’s edition of The Times of London: “Chancellor on brink of second bailout for banks.”

It wasn't a story. It was a manifesto. A diagnosis. The book existed because the library was failing. Its entire reason for being was encoded in its first line.

The ending was written in the first block. The first page. Foreshadowing of the highest order.

Does A Book Matter If No One Reads It?

For a long time, almost no one cared. A few libertarians, a few coders, a handful of academics. They were the first readers. They’d pass the book around, marveling at its design. They used it to buy pizza. Ten thousand copies of the book for two pizzas. At the time, it seemed like a funny experiment. In hindsight, it was the most expensive carbohydrate ingestion in human history.

But a funny thing happens with a book like this. A book with a fixed number of copies. A book whose creation schedule is fixed, predictable, and slows down over time.

It has a peculiar plot device called the halving where the reward for writing a new page gets cut in half every 210,000 pages, or roughly four years.

As the Fiat Library kept printing, its story got weaker. Each new dollar, euro, or yen they printed was a tiny tax on everyone holding the old ones. The paper was visibly rotting now. But as the Fiat Library’s noise grew louder, the Bitcoin book’s signal became clearer.

It was a strange new form of gravity.

The first person I met who really got it wasn’t a cypherpunk.

He was a former Wall Street guy. He had spent twenty years playing the game inside the Fiat Library. He knew all the tricks. He knew that the whole system was a confidence game propped up by ever-increasing amounts of debt and complexity. He described his job as “skimming rounding errors off the decay of civilization.”

One day in 2012, he stumbled across the book.

He didn’t care about the libertarian philosophy. He didn’t care about the elegant code. He was a numbers guy. He saw two things. First, he saw a fixed supply of 21 million. An asset with no supply response to an increase in demand. It was the hardest property on planet Earth. Harder than gold, which you can always mine more of if the price is right.

Second, he saw the Fiat Library’s printing press, and he saw that the ‘On’ switch was permanently stuck.

“It was the simplest trade I’d ever seen,” he told me, sipping a green smoothie in a Tribeca cafe. “You have one asset whose supply is programmatically, mathematically, divinely capped. And you have another asset… the one everything else is priced in… whose supply is infinite. People who don’t care about the far-off future can print more of it at will, to suit their own immediate needs. What do you think is going to happen? It’s not calculus.

It’s a children’s see-saw. One side weighs 995 pounds. The other weighs 5 pounds. One of them is about to go flying.”

He put most of his net worth into it. His friends at Goldman Sachs thought he was insane. “They were all reading the same rotting books, patting each other on the back for being able to decipher the latest blurry chapter from the Fed,” he said. “I just decided to buy the one book that was written in stone.”

Corporations Become The Biggest Readers

Then came the second wave of readers. They weren't people, really, they were imaginary people they call corporations. Publicly traded companies. The first was a guy named Michael Saylor, the CEO of a software company called Strategy. He was a classic Michael Lewis character: an intense, brilliant, slightly off-kilter engineer who’d made and lost a fortune in the dot-com bust and was pathologically obsessed with finding the truth.

His problem was the same as everyone else’s, just on a much bigger scale. He had a corporate treasury, hundreds of millions of dollars sitting in cash. But the cash wasn’t sitting. It was melting. He described it as a “melting ice cube.” The authors of the Fiat Library were aiming their blowtorches right at his balance sheet.

So he did the only logical thing a hyper-rational engineer could do. He converted his melting ice cube into a block of granite. He took all of his company’s cash reserves and bought the book. Then he took on debt to buy more copies.

Wall Street went berserk. They called him reckless, a gambler. But they were missing the point. He wasn’t speculating. He was escaping. He was the first person to realize that in a world where the primary savings vehicle is designed to lose value, the riskiest thing you can do is hold it. The truly conservative move was to find the emergency exit.

He wasn’t just reading the book, he was moving his entire company onto its single, perfect page.

And that’s when the gravity really started to shift.

Because every time a new, major reader, a corporation, a hedge fund, an insurance company, decided to buy a copy, they weren't just buying an asset. They were strengthening the book. Each new owner was another guardian of the story, another node in the network. Capital energy flowing in. The book got stronger with every corporation, nation, or individual who started to read it themselves. It was an anti-fragile story: the more stress you put on it, the more attacks it weathered, the more believers it gained, the more powerful its signal became.

Plot Twist: Monetary Singularity vs Fiat Collapse

The final plot twist is the most delicious one. The one that reveals the true nature of the whole system.

The Fiat Library isn’t just poorly made. It’s not just a bad series of books printed on rotting paper. It’s designed to self-destruct.

Let’s go with a classic: that’s not a bug; it’s a feature. The entire post-1971 global monetary system is built on a foundation of constant, managed inflation. A little bit of rot, every single year. The authors believe this is necessary to encourage spending and investment, to grease the wheels of the economy.

But a little bit of rot, compounded over fifty years, leaves you with a pile of dust.

They built a disposable library because they believed they could always print a new one. What they never counted on was someone building a permanent one. A library of one.

The more pages the fiat authors add to their crumbling library, the more they print their story into meaninglessness, the more valuable the one, perfect book becomes. Their panic is the bitcoin book’s marketing campaign. Their money printer is its engine of value accrual. They are locked in a death spiral that only serves to strengthen the thing that is replacing them.

Sooner or later, you have to decide which book to put on your own shelf. You don’t have to go “Full Saylor”. You can’t replicate buying 100s of BTC at a time.

But you can buy bitcoin every 2-weeks when your paycheck arrives. You can use your IRA to gain exposure to companies with a bitcoin strategy. You can build fiat wealth engines (dividend income portfolio, e-commerce business, etc..) and use the proceeds to buy BTC.

It’s no longer an abstract decision. It’s the defining financial choice of the 21st century. One book turns to dust before you can finish a chapter, its value leaking away with every tick of the clock. The other is a strange, perfect thing, a story written by a ghost and secured by the laws of physics. It’s a story that will outlast us all.

The choice seems obvious. But it’s never that simple, is it? It requires a leap. It requires you to stop believing in the grand, noisy library and trust the quiet, simple signal of the single book.

Most people won’t do it.

Not yet. It’s too strange, too new.

They’ll keep holding onto the rotting pages, hoping the authors in the back room can somehow figure out a new plot twist to save the story.

But the ending is already written. It has been from the very first page.

P.s. the fiat library folk will talk about academic concepts to defend their endless printing, but here’s a reminder of how the technocrats in power use academia + media to “sell” their ideas to the global population:

The Efficient Market Hypothesis Is Bullshit

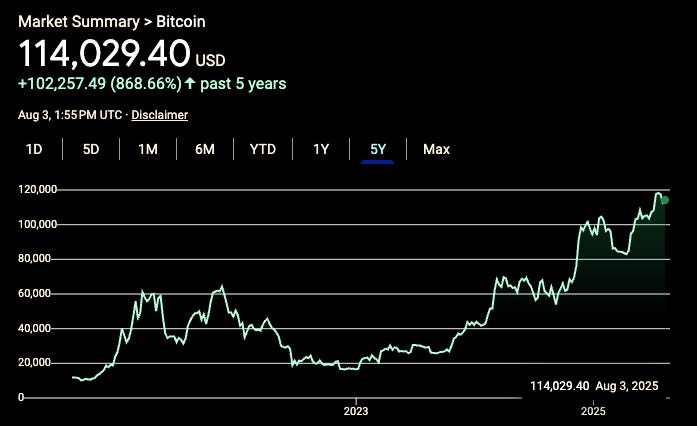

I was tempted to just post a picture of the Bitcoin price chart and drop the mic.

Friends: in addition to the 17% discount for becoming annual paid members, we are excited to announce an additional 10% discount when paying with Bitcoin. Reach out to me, these discounts stack on top of each other!

👋 Thank you for reading Wealth Systems.

I want to learn what topics interest you, so connect with me on X.

…or you can find me on LNKD if that’s your deal.

I started Wealth Systems in 2023 to share the systems, technology, and mindsets that I encountered on Wall Street. I am a Wall St banker became ₿itcoin nerd, ML engineer & family office investor.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.

Matt, this is the sauce! It's everywhere. Just as the Fiat Library is a proxy for real value, our society has trained us to chase proxies for knowledge (diplomas), power (votes), competence (follower counts) and so on. We've been taught to value paper.

I've been writing about this from the perspective of how individuals get trapped in this "proxy economy". The ultimate plot twist is that the only true anti-fragile asset isn't just Bitcoin; it's the sovereign mind that refuses proxies and builds from first principles.

This is a powerful read.

Matt, this is the sauce! It's everywhere. Just as the Fiat Library is a proxy for real value, our society has trained us to chase proxies for knowledge (diplomas), power (votes), competence (follower counts) and so on. We've been taught to value paper.

I've been writing about this from the perspective of how individuals get trapped in this "proxy economy". The ultimate plot twist is that the only true anti-fragile asset isn't just Bitcoin; it's the sovereign mind that refuses proxies and builds from first principles.

This is a powerful read.