Zero-Based Wealth Building

Most of us don’t realize the incredible power we have over our lives. We aren’t just actors playing out a script… we are empowered to edit the screenplay, change direction or the cast entirely.

Take charge of your life by taking measurement of it first.

From time to time, typically near the end of the year, I drop everything I am doing and ask myself very basic questions about my life.

What projects am I working on?

Which relationships am I building and developing?

What goals did I have for this year and how are we looking?

This is a form of zero-based thinking. Zero-based thinking is a method of decision-making where you start from a "zero base" – meaning you question all existing assumptions and approaches.

One of the reasons we rarely use our Writer / Director credentials and stick to just “playing our role” is our failure to take stock like this. Stepping back gives you perspective and if you have a growth mindset and a willingness to change course (reverse course, even) your life will blossom in unexpected but beautiful ways.

ZBT allows you to analyze the situation as if you were starting from scratch, regardless of any previous decisions or investments. Here's how it works:

Identify and Question Current Activities: List everything you're currently doing in a particular area (e.g., a project, a department, your personal life).

Evaluate with Hindsight: Ask yourself, "Knowing what I know now, would I start this activity again today?"

Go Back to Zero: If the answer is "no" or "maybe with changes," it's time to re-evaluate. Imagine you have a clean slate. What would you do differently?

Make Decisions Based on Current Needs: Don't let past decisions or sunk costs influence your current choices. Focus on what makes the most sense right now.

Zero-based Thinking & Building

I take zero-based thinking to the next step: zero-based building. This means writing down these ZBT thought exercises, taking the findings and using them to develop plans to modify my wealth system.

Building around this practice ensures agility, efficiency and maximizes my family’s opportunity to take advantage of all that life offers.

Here's how to apply ZBT to your personal wealth system. Cut across the major elements of your wealth world and ask the big questions. Take no assumptions with you, just imagine this is your first time ever really mapping this out.

Financial Goals: What are your short-term and long-term financial goals? Are they realistic and aligned with your values?

Mindset: What are your beliefs and attitudes about money? Are they empowering or limiting?

Income: What are your current income sources? Are they aligned with your passions and goals? Are there any untapped opportunities? Could one become more passive? Could another increase yield if you invested more time, money or other resources?

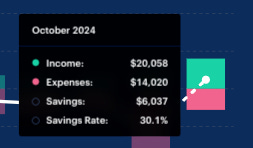

Expenses: Track every expense. Question each one: Is it necessary? Does it bring value to your life? Are there cheaper alternatives? Could it be purchased in bulk?

Savings & Investments: Where is your money saved and invested? Are these the best options for your risk tolerance and goals? Are you diversified enough?

Debt: What kind of debt do you have? (Student loans, credit cards, mortgage) Is it manageable? What are the interest rates? What are the covenants?

Financial Habits: What are your daily, weekly, and monthly financial habits? Do they support your goals or sabotage them?

General Questions:

Knowing what you know now about your finances, would you make the same choices again?

Are your current habits and strategies helping you build wealth and achieve your goals?

Are you living within your means and saving enough for the future?

Are your investments scheduled to generate enough returns for your financial objectives or will you need to add more wealth engines?

Typically at this point my brain is buzzing.

If you need a little extra prompting, these are good additional questions to use in your thinking and building:

Imagine you were starting from scratch with your finances. What would you do differently?

What new income streams could you explore?

What expenses could you eliminate or reduce?

What savings and investment strategies would you prioritize?

How could you improve your financial habits and mindset?

Now that you’ve written all this down, start to trace this back to your priorities and long-term desires. What steps can you take to achieve those goals?

Zero-based Building: McDonagh Family Office

Let’s apply this to my own business, managing our family office.

My time on Wall Street taught me many things: the power of leverage, the art of valuation, and the relentless pursuit of alpha across all dimensions. But it also revealed a fundamental truth: true wealth transcends quarterly earnings reports and fleeting market trends. It's about building a legacy that endures, a financial fortress that safeguards your family's future for generations to come.

That's the vision driving my family's wealth system.

We're not just accumulating assets; we're constructing a dynamic engine designed for perpetual growth, fueled by diversified income streams and strategic asset allocation.

The Pillars of Our Wealth System

Income Generation:

Multiple Streams: We're not reliant on a single source of income. My software business generates consistent cash flow, while dividend-paying stocks provide a steady stream of passive income. We're constantly exploring new opportunities to diversify further, from real estate to royalties to alternative investments.

Value Creation: We focus on building businesses and acquiring assets that generate real value, not just speculative gains. This means investing in companies with strong fundamentals, developing intellectual property with long-term potential, and acquiring income-producing assets with durable competitive advantages.

Capital Appreciation:

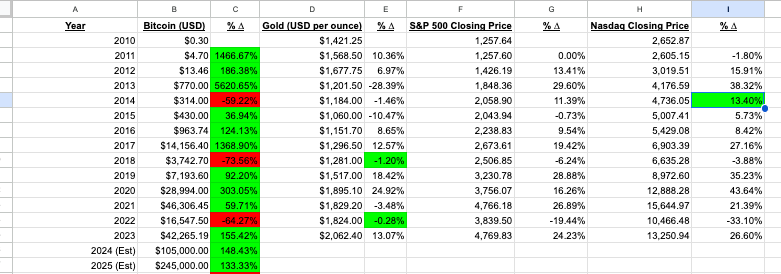

Bitcoin Treasury: We view Bitcoin as a generational store of value, a digital gold that transcends fiat currencies and geopolitical risks. We're steadily accumulating Bitcoin, treating it as a long-term hedge against inflation and economic uncertainty.

Equities for Income: Dividend-paying stocks form the core of our equity portfolio. These provide a consistent income stream that we reinvest to further compound our wealth. We focus on companies with a history of dividend growth and strong financial health.

Opportunistic Investments: We maintain a portion of our portfolio for opportunistic investments in high-growth sectors and emerging technologies. This allows us to capture potential upside while maintaining a diversified foundation.

Expense Management:

Strategic Spending: We're not frugal, but we're strategic. We invest in experiences and assets that appreciate in value or enhance our quality of life. We avoid frivolous spending and prioritize long-term value over short-term gratification. Tracking expenses creates the visibility you need to clean-up wasteful spending. Once you see how much you are saving each month, and which categories prevent you from reaching your goals… you can make strategic decisions to build your wealth.

Tax Optimization: We actively manage our tax liabilities through legal and ethical means. This includes utilizing tax-advantaged accounts, optimizing business structures, and staying informed about tax laws. This is one area it really pays to work with experts.

The Perpetual Growth Engine

Our wealth system is designed to operate as a perpetual growth engine. Income generated from our various sources is reinvested into assets that appreciate in value or generate further income. This creates a compounding effect that accelerates wealth accumulation over time.

We're not just building wealth; we're building a system. A system that constantly adapts, evolves, and optimizes itself for long-term growth. This Zero-Based approach ensures that our family's financial future is secure, resilient, and positioned for continued prosperity.

This is our legacy. This is how we build a dynasty.

What will be your legacy?

👋 Thank you for reading Wealth Systems. I started this in November 2023 to share the systems, technology, and mindsets that I encountered on Wall Street.

💡The BIG IDEA is share practical knowledge so we can each build and optimize our own wealth engines and combine them into a wealth system.

To help continue our growth please Like, Comment and Share this.

NOTE: The content provided on this blog is for informational purposes only and does not constitute financial, accounting, or legal advice. The author and the blog owner cannot guarantee the accuracy or completeness of the information presented and are not responsible for any errors or omissions or for the results obtained from the use of such information.

All information on this site is provided 'as is', with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied. The opinions expressed here are those of the author and do not necessarily reflect the views of the site or its associates.

Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise. Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

The author is not a broker/dealer, not an investment advisor, and has no access to non-public information about publicly traded companies. This is not a place for the giving or receiving of financial advice, advice concerning investment decisions, or tax or legal advice. The author is not regulated by any financial authority.

By using this blog, you agree to hold the author and the blog owner harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries as a result of any investment decisions you make based on information provided on this site.

Please consult with a certified financial advisor before making any investment decisions.